Chart of the Month: December 2022

The Crypto Winter of Discontent: Examining the Value of Venture Capital Tech over the Past Decade

Cryptocurrency values continue to be hammered in 2022, revealing many crypto-focused hedge funds and exchanges have been built on a foundation of highly leveraged sand.

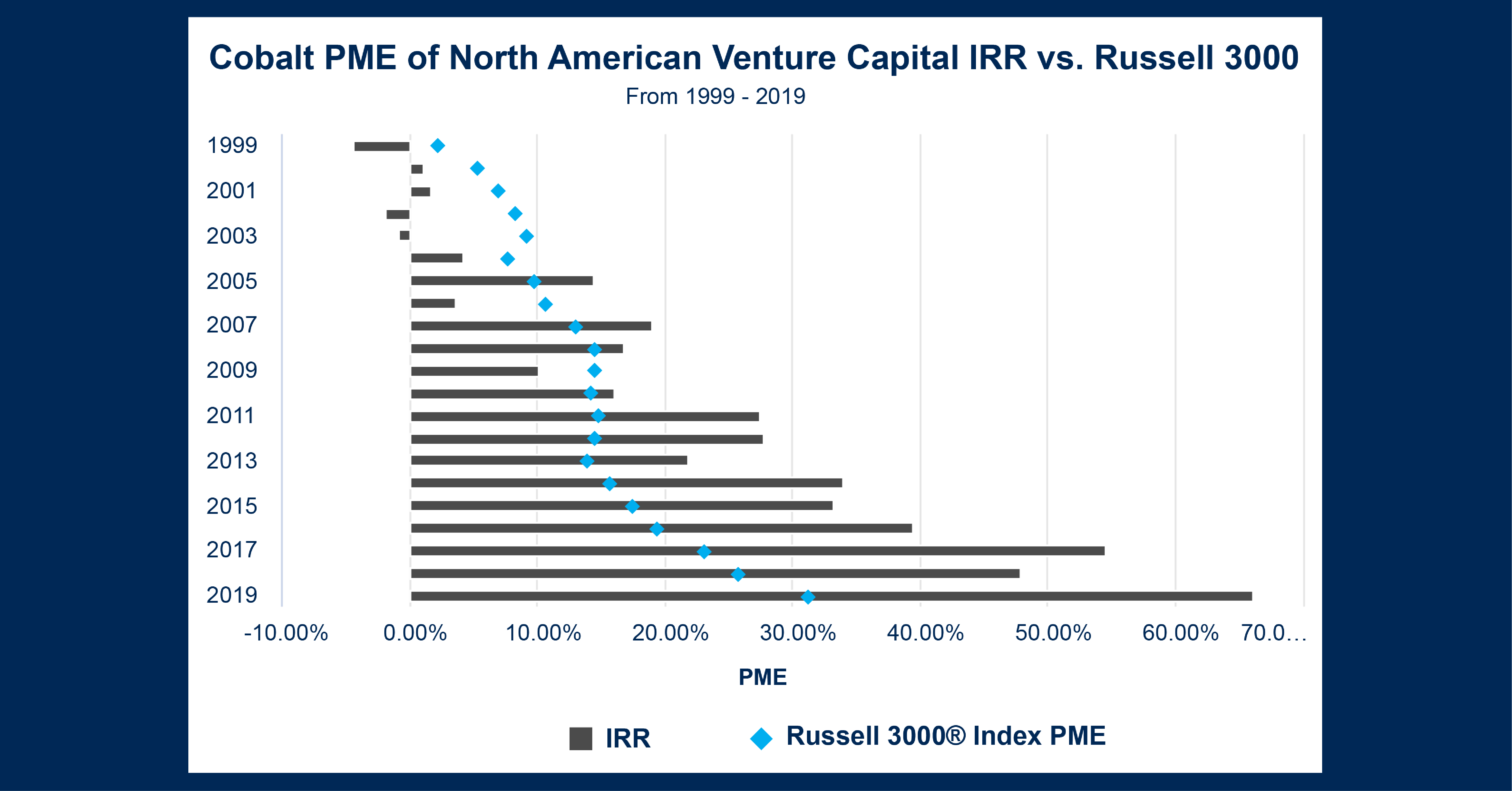

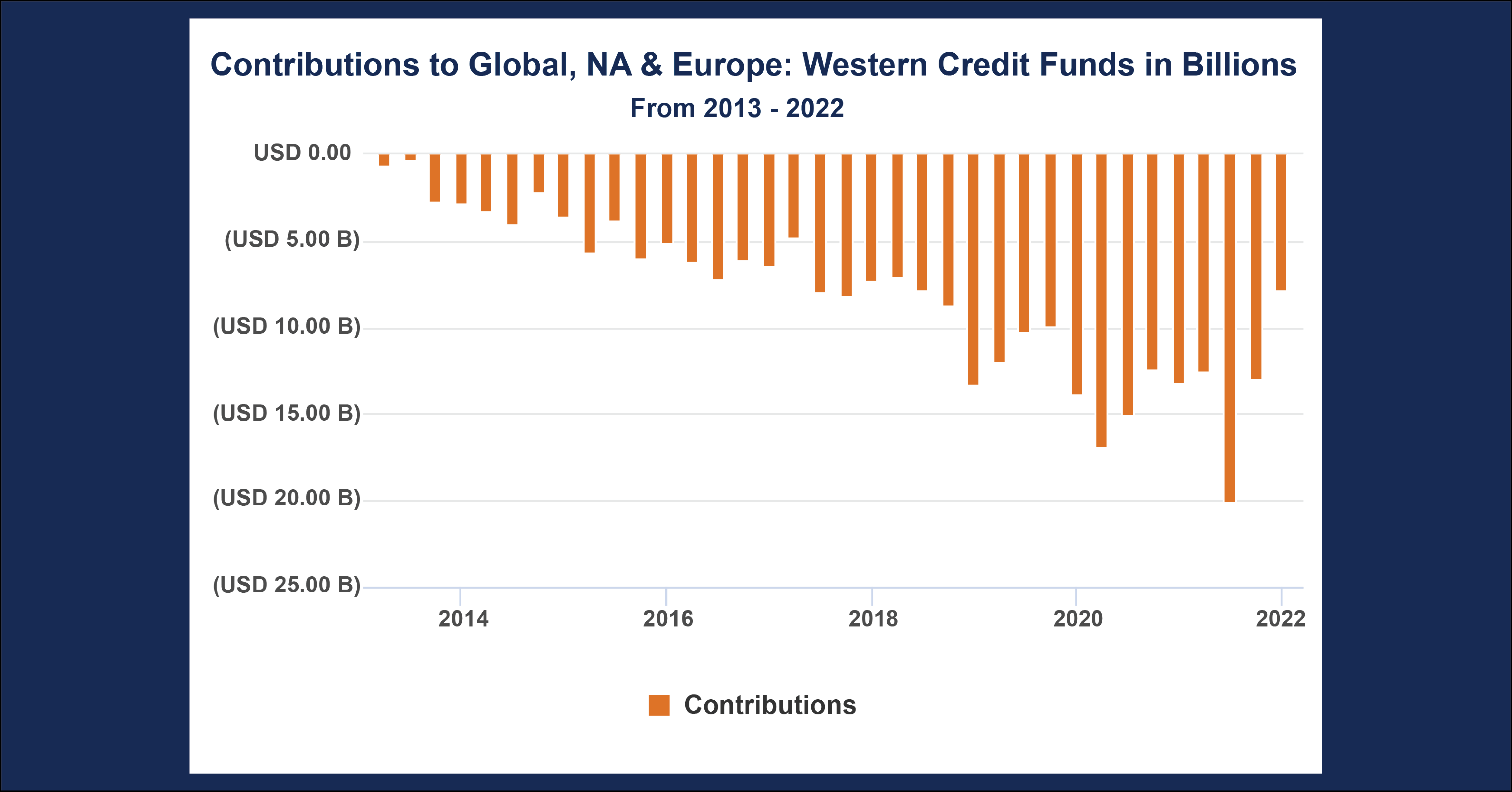

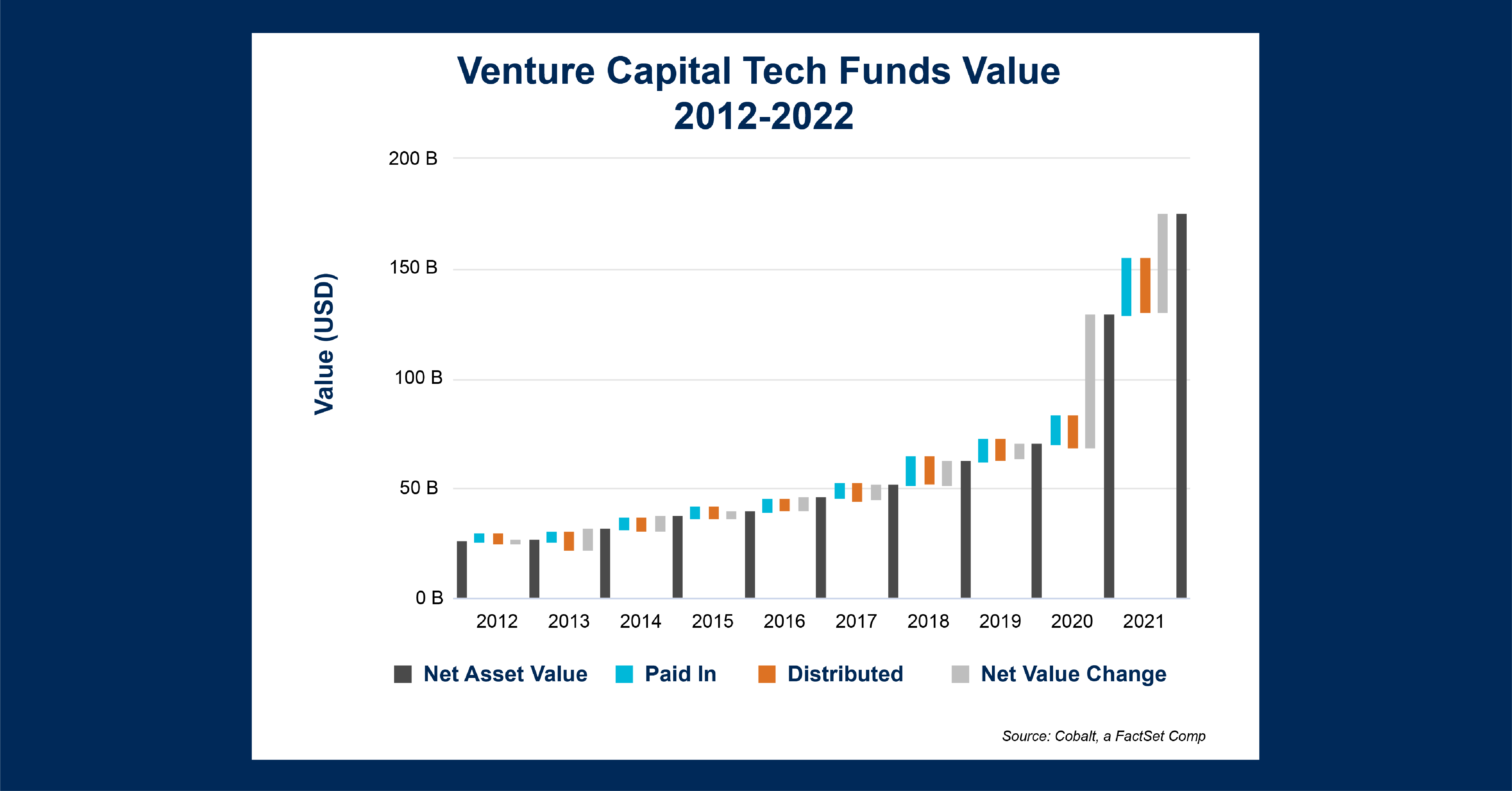

Considering the “crypto winter” befalling the industry (and the upcoming seasonal winter in the Northern Hemisphere), we’ll look at the lead-up to the downfall to see how we got here. As such, we built a portfolio of 185 venture capital funds with a technology focus, using quarterly data as a proxy for interest in crypto investment over the past decade.

Key Takeaways:

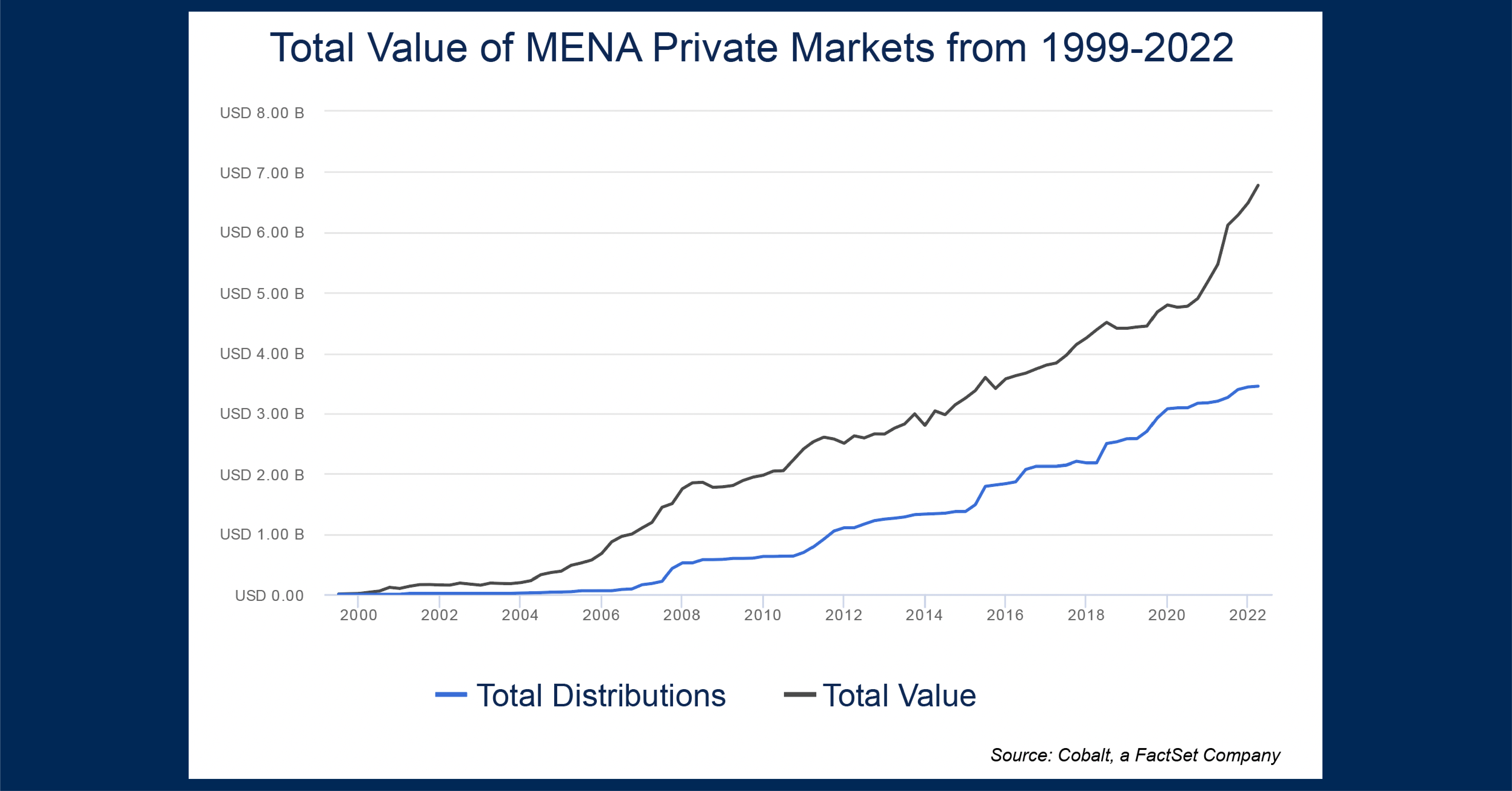

- The most obvious takeaway from this chart is the consistent upward net asset value (NAV) growth from 2012 to 2022. As part of the “everything bubble,” venture tech (and tech as a whole) has been a highly expansive industry of late. The associated rise in asset value reflects this steady growth. In addition, it’s clear that contributions and distributions have also correspondingly risen over this period, further indicating increased interest and payout from these investments.

- However, we see the monumental rise in NAV since 2020 has more than doubled the total invested value in previous years. Understandably, contributions and distributions would not rise at the same rate as NAV in the case of a rapid rise in consumer demand for the underlying technologies. If this enormous NAV is not quickly captured through distributions, the gains may evaporate for general and limited partners just as easily as they arrived.

Looking Ahead:

- As consumer confidence in technology and crypto has shifted from skepticism to fervor (and incredible market cap growth) to distrust over the past several years, the chart shows an industry poised for its coming fall. The rise of drawdowns and defaults could create significant impairment for retail and institutional demand.

- On the other hand, technology continues to underpin economic growth in our modern society. If faith in tech big and small is restored and macro conditions improve, the drawdown could slowly reverse

Subscribe to our blog:

Chart of the Month: April 2024

Surge Pricing: Examining the Ability to Adjust North America Infrastructure Investing on a Short Timeline The state of Infrastructure investing…

Chart of the Month: March 2024

Law of Averages: Comparing 3 Decades of Commitments Among Buyout, Venture Capital, and Credit Funds In private markets, we regularly…

Cobalt Expands Data Regions: A Step Forward in Addressing Data Residency Concerns while Ensuring Security, Privacy, and Control

Cobalt Expands Data Regions: A Step Forward in Addressing Data Residency Concerns while Ensuring Security, Privacy, and Control At Cobalt,…