Benchmarking for the competitive GP

Gather critical insights on peer GPs plus LP investment trends to maintain your edge on investment, fundraising, and LP targeting strategies.

Cobalt Market Data

by the numbers

8,691

Firms

8,325

funds with performance

$14.4T

capital raised

$9.3T

Investment $ Tracked

69,768

portfolio investments

Take a closer look:

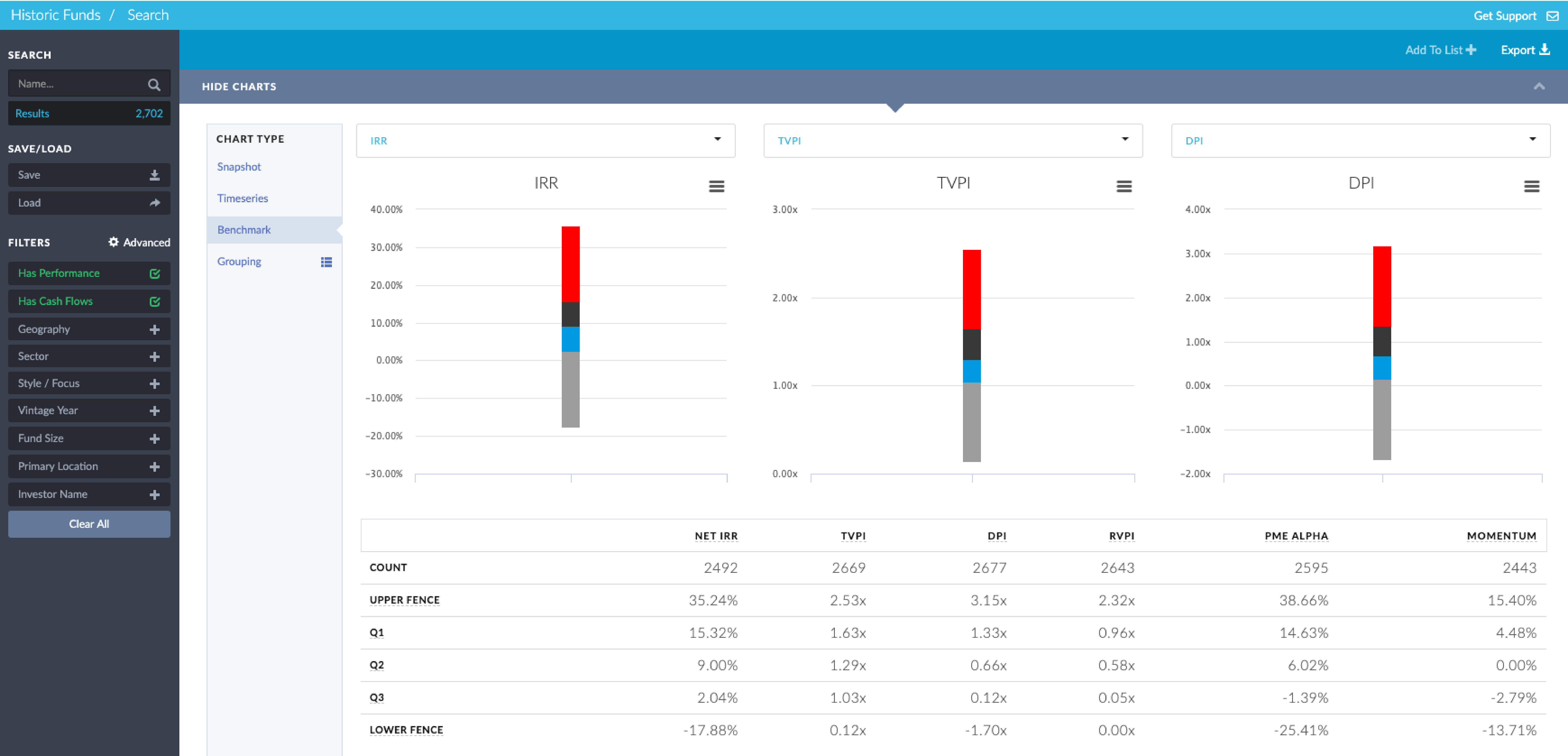

Competitive GP Performance Benchmarks

Access Cobalt’s fully transparent performance information sourced exclusively from LPs, drilling down to specific investor returns.

- Represents approximately 68% market coverage

- Includes historical performance metrics to analyze firm, fund, and industry trends over time.

Dig into the Hamilton Lane Performance Benchmark, built from daily cash flows and representing:

- $5.8T of private markets capital

- 87% institutional-quality funds over $100M

- 50%+ of capital ever raised

- 43 vintage years

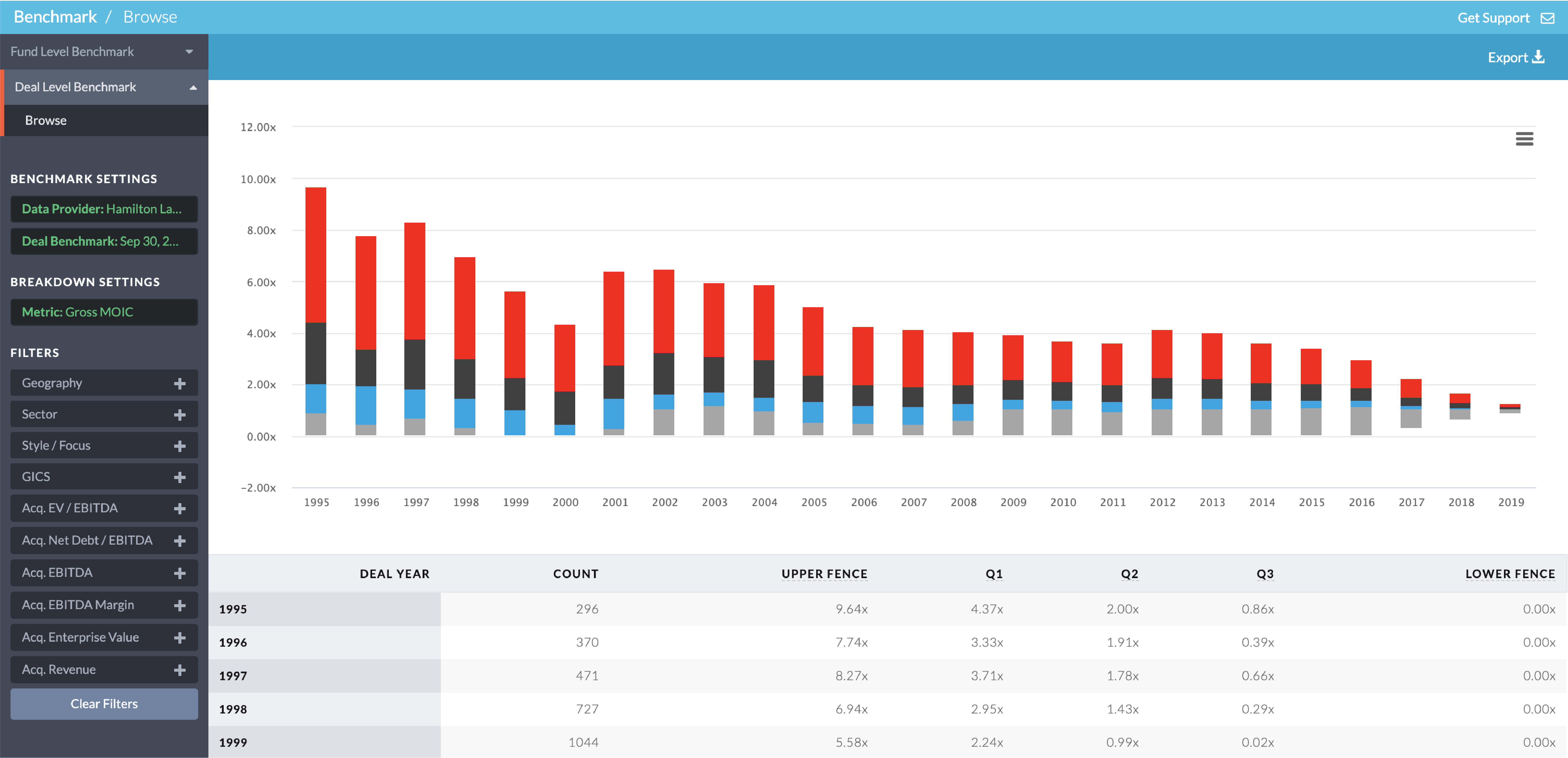

Deal Benchmarks

An industry-leading private company dataset developed by Hamilton Lane, the deal benchmark is comprised of 55,000+ deals across various industries and $3.25T* in total invested capital and includes:

- Performance (multiples / IRR)

- Acquisition and Current / Exit multiples

- Purchase multiples (EV / EBITDA multiples)

- 24 years of data

- Leverage levels (net debt / EBITDA multiples)

- Four layers of GICS filtering

*As of 03/31/20

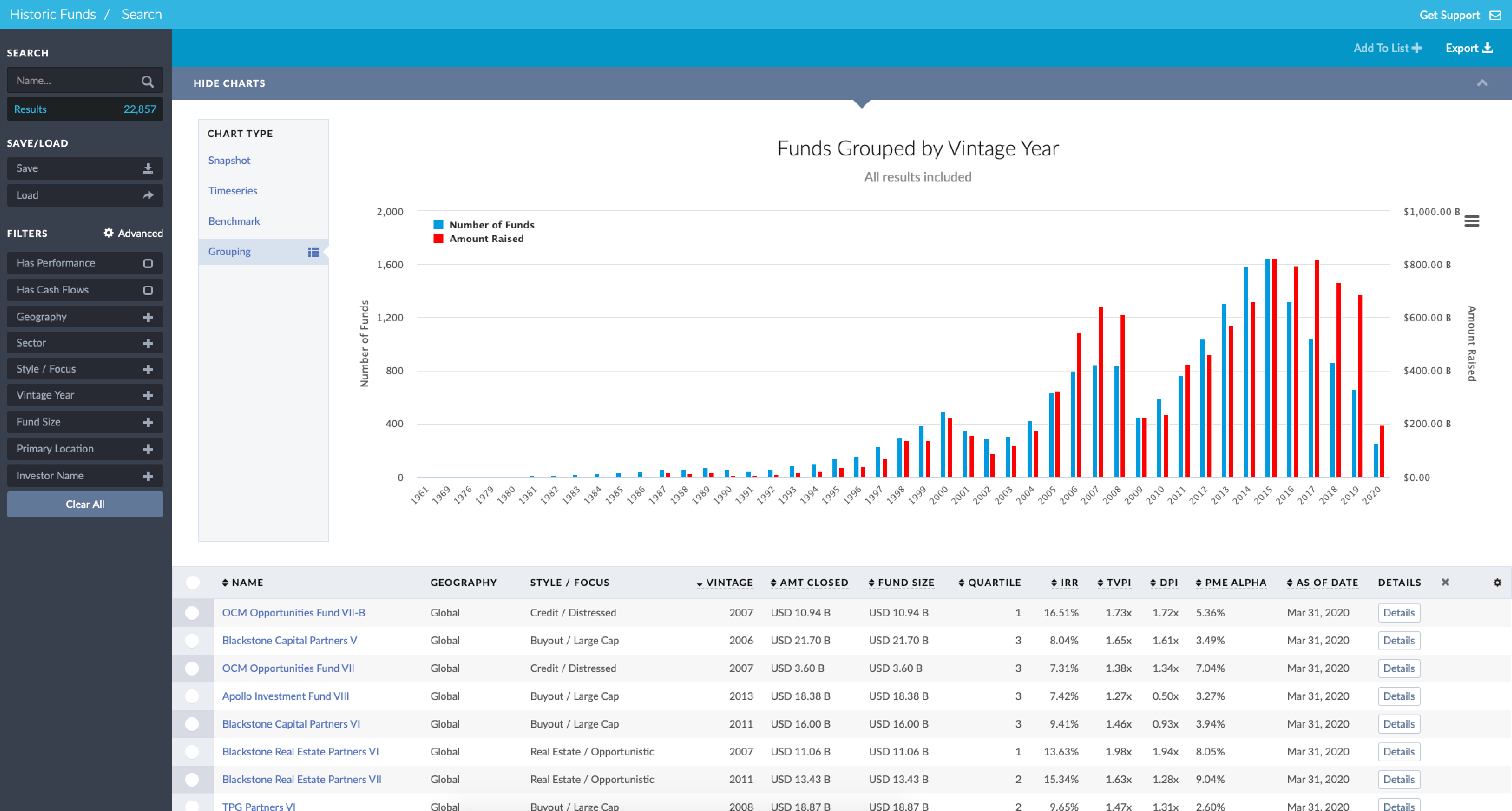

Cobalt Fundraising Dataset

Produced by Cobalt, this comprehensive dataset includes historical fundraising data and funds in / coming to market.

- Covers over $12.9T raised

- Data is collected from public sources and Hamilton Lane

- Up to 3-year projections on fundraising, developed using proprietary algorithms, in collaboration with Hamilton Lane

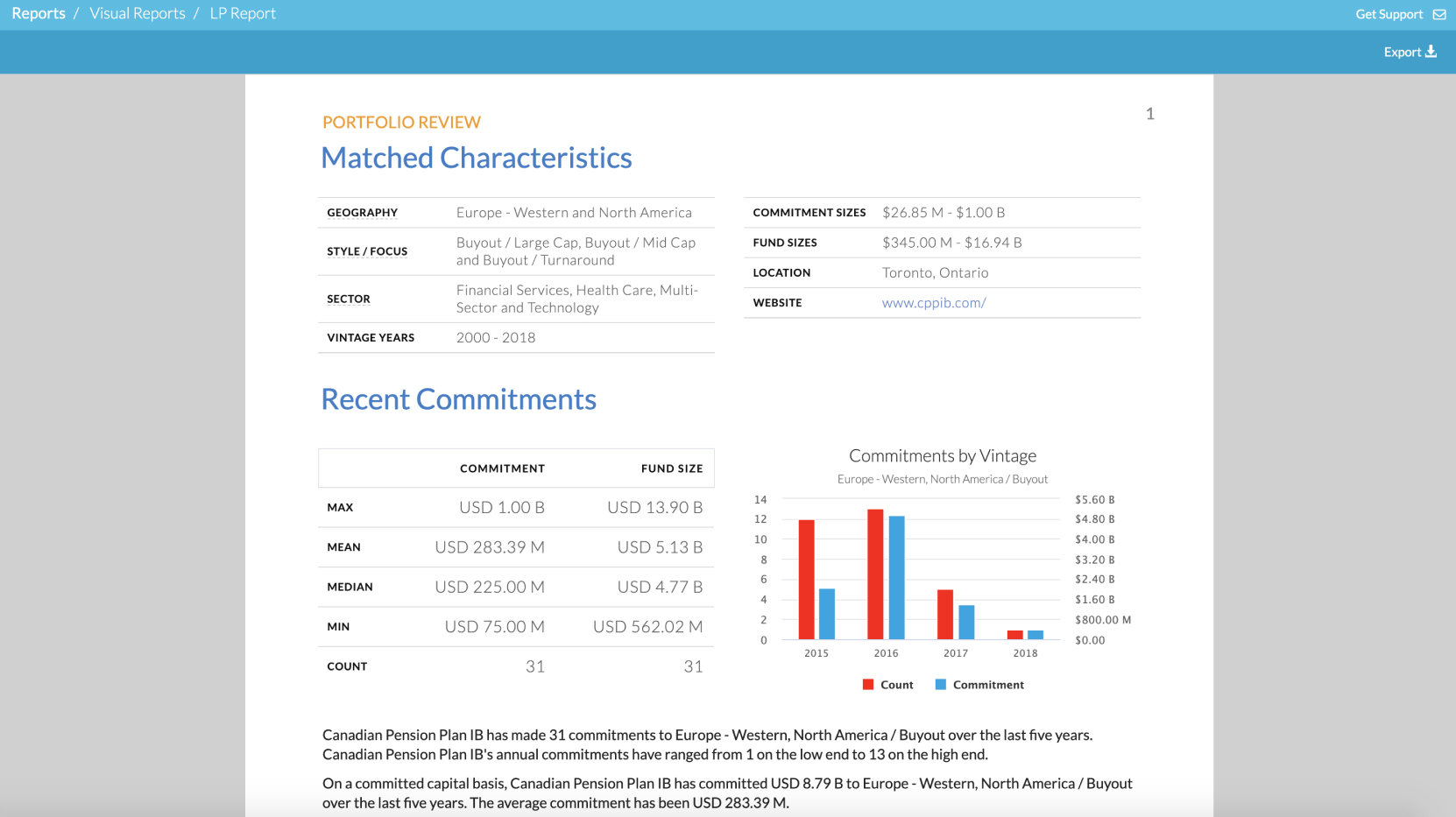

Cobalt LP Insights

Independently sourced and verified by the Cobalt research team, our datasets on LP private capital holdings and contacts are critical tools for private equity teams looking to expand or refine their LP strategy.

- Covers 3,500 LPs and 63,000 unique investments.

- Dig into the private equity portfolio holdings of more than 1,275 institutional limited partners

- Collected exclusively from publicly available sources and includes data from endowments, insurance companies, non-profit foundations, private and public pension plans, sovereign wealth funds, and Taft-Hartley plans.