Chart of the Month: September 2021

The Amber Wave: A Look at North American Buyouts Compared to the Russell 3000

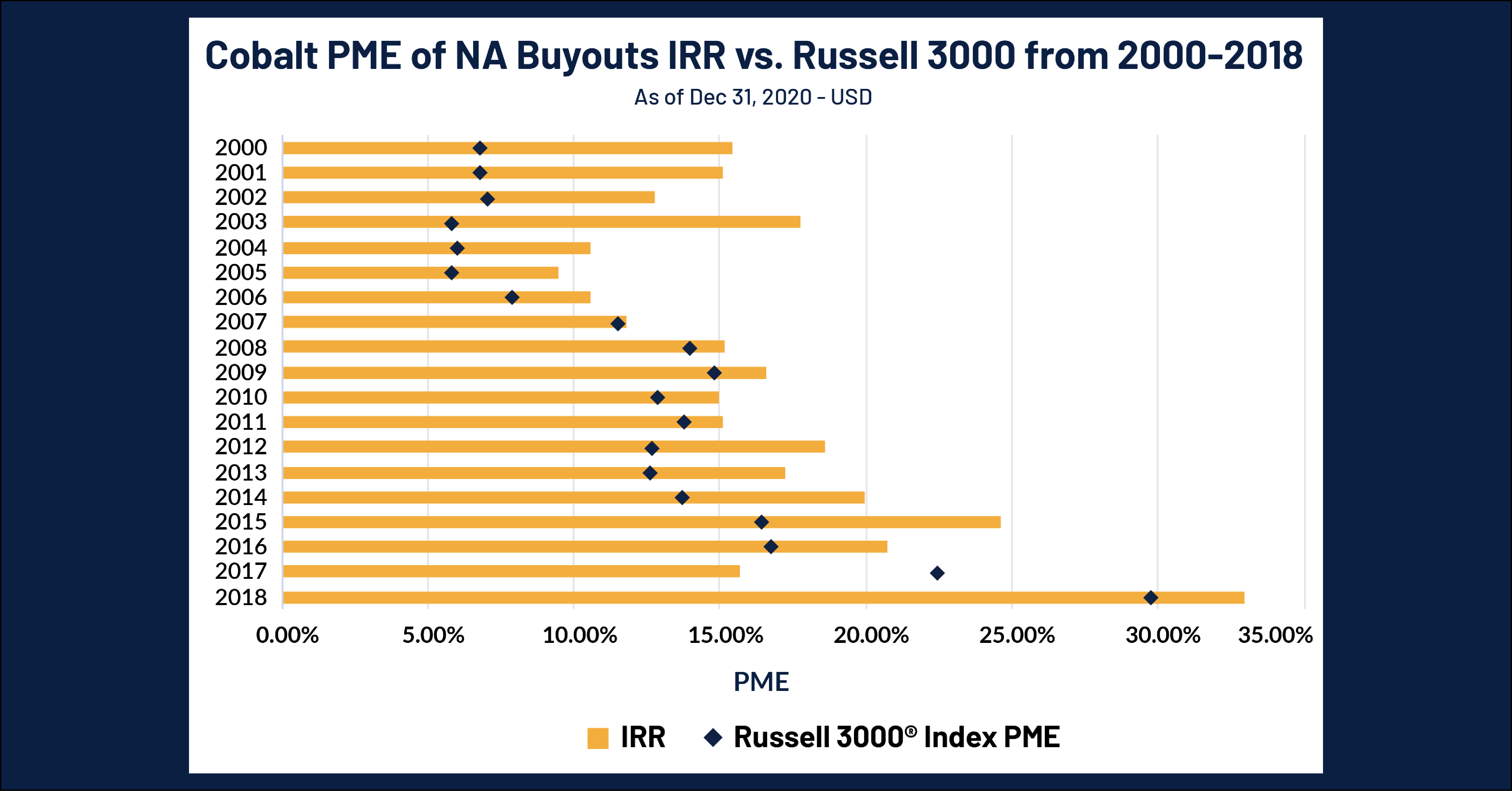

Given the volatility of the past year’s returns across the broader markets, we took a wide look at a fundamental point in question: the state of public market vs. private market returns. We plotted the Russell 3000’s PME against the returns of North American Buyout funds using our in-house PME calculation to see what characteristics each side of the market have demonstrated over the past 20 years.

Key Takeaways:

- Between the Dot Com bubble and the Great Financial Crisis (GFC) we can see a strong period of outperformance from the private market sample above, routinely outperforming the public market benchmark by 5-10%. This gap shrunk as the GFC approached since public markets tend to see progressively higher performance several years after a recession as public bull markets pull high-capital interest.

- In the aftermath of the GFC, both markets would remain relatively steady and even. However, after 2012, strong re-investment into private markets would once again push a widening of the performance gap. Private markets’ long horizons give an ability to invest more heavily into recessions, resulting in a much quicker uptick in performance coming out of recessions than seen in public markets.

- After 2016, the IRR’s exhibit higher variance than their long term returns on account of the short time that has elapsed since inception. Nevertheless, we can see a continual push towards parity as both public and private returns continued to climb higher in the late 2010’s bull market, feverishly pushing for performance on all fronts. Private equity’s long-term horizon is responsible for this short term volatility, but a smoothing effect can be seen in a fund’s performance during economic downturns and throughout the full life span of a fund.

Looking Ahead:

- Notably absent from this examination is the recession of 2020, as the pandemic created sharp but brief drawdowns in public equities. We wait to see if the private market advantage of investing into recessions once again sees a return to dominance.

- However, the brevity of the 2020 recession and the rapidity of the recovery could allow public markets to close the gap far faster than prior recessions.

- Given the public/private comparison of bull market run-on strength vs. recessionary opportunity evident in the recent past, it will be interesting to see if these behaviors remain, or if macroeconomic forces alter the standards of outperformance.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…