Chart of the Month: March 2022

Road Repair: A Comparative Study of Regional Infrastructure Investment

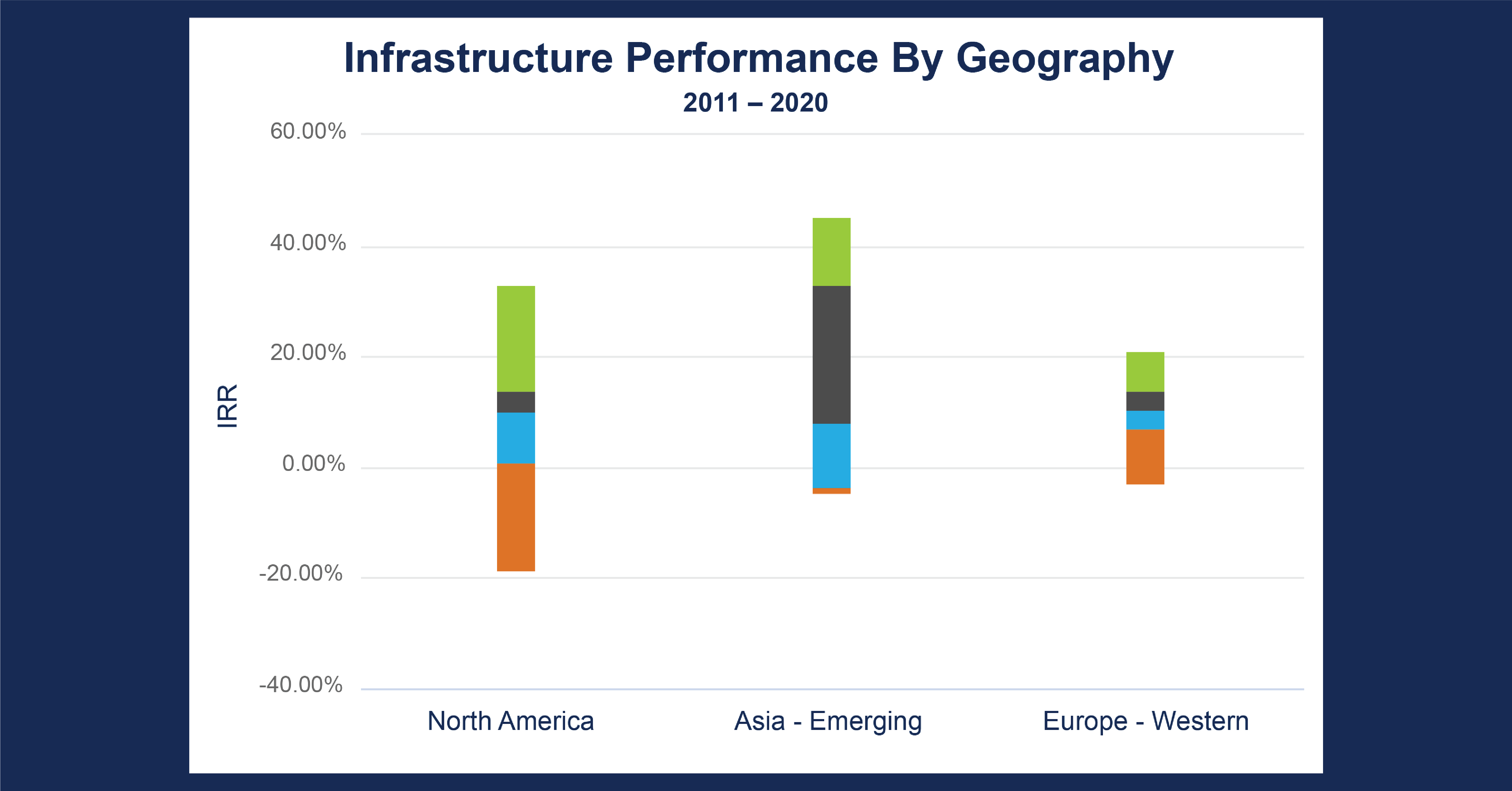

This month’s chart takes a closer look at the infrastructure landscape we analyzed back in August of 2021, and digs into the varying performance across geographies. Using the Cobalt Market Data, we looked at infrastructure funds from the past 10 years across North America, Western Europe, and Emerging Asia by IRR to understand how the investing landscape may be different across regions.

Key Takeaways:

- Emerging Asia has offered the greatest returns over the past decade, with the highest top-quartile group, as well as the highest median IRR of 12.72%, compared to 11.08% for North America and 9.63% for Western Europe.

- Western Europe offers the ‘safest’ option, with the lowest spread between the 1st and 3rd While not having the upside of the other 2 regions, Europe has given the most stable range of returns over the past 10 years.

- Conversely, North America has the widest range of outcomes, with the lowest range for bottom quartile performers. While this could be attributed to the sheer number of North American infrastructure funds, the numbers do tell the story of a high-risk, high-reward investment environment.

Looking Ahead:

- A number of global events should come to shape the next decade of infrastructure investment. Globally, the post-pandemic recovery will continue weigh heavily on resources put towards infrastructure. And while it may not persist for the duration of a vehicle with a 10+ year investment horizon, the supply chain issues being seen across the world may come to play a factor in this space as well.

- In China, the Evergrande fallout may reverberate throughout the investing landscape of real estate and infrastructure in Emerging Asia.

- In North America, the recently passed infrastructure bill will inject trillions of dollars in projects into the space, and it will remain to be seen how this affects the performance of the players in the space.

Subscribe to our blog:

Changing Fortunes: Tracking 20 Years of Returns Across Credit and Venture Capital

Changing Fortunes: Tracking 20 Years of Returns Across Credit and Venture Capital Last month, the Federal Reserve announced its first…

Introducing Cobalt Comment Threading

Say hello to streamlined Portfolio Company communication, and goodbye to notification overload. Whether you manage tens or hundreds of portfolio…

Measuring Momentary Impacts of Latin America Presidential Elections on Public and Private Markets

Measuring Momentary Impacts of Latin America Presidential Elections on Public and Private Markets Investors often look at the future economic…