Measuring Momentary Impacts of Latin America Presidential Elections on Public and Private Markets

Measuring Momentary Impacts of Latin America Presidential Elections on Public and Private Markets

Investors often look at the future economic policies of presidential candidates to forecast public versus private market elevation. Latin America has had many recent presidential elections that give us a quality sample size to analyze if a connection exists.

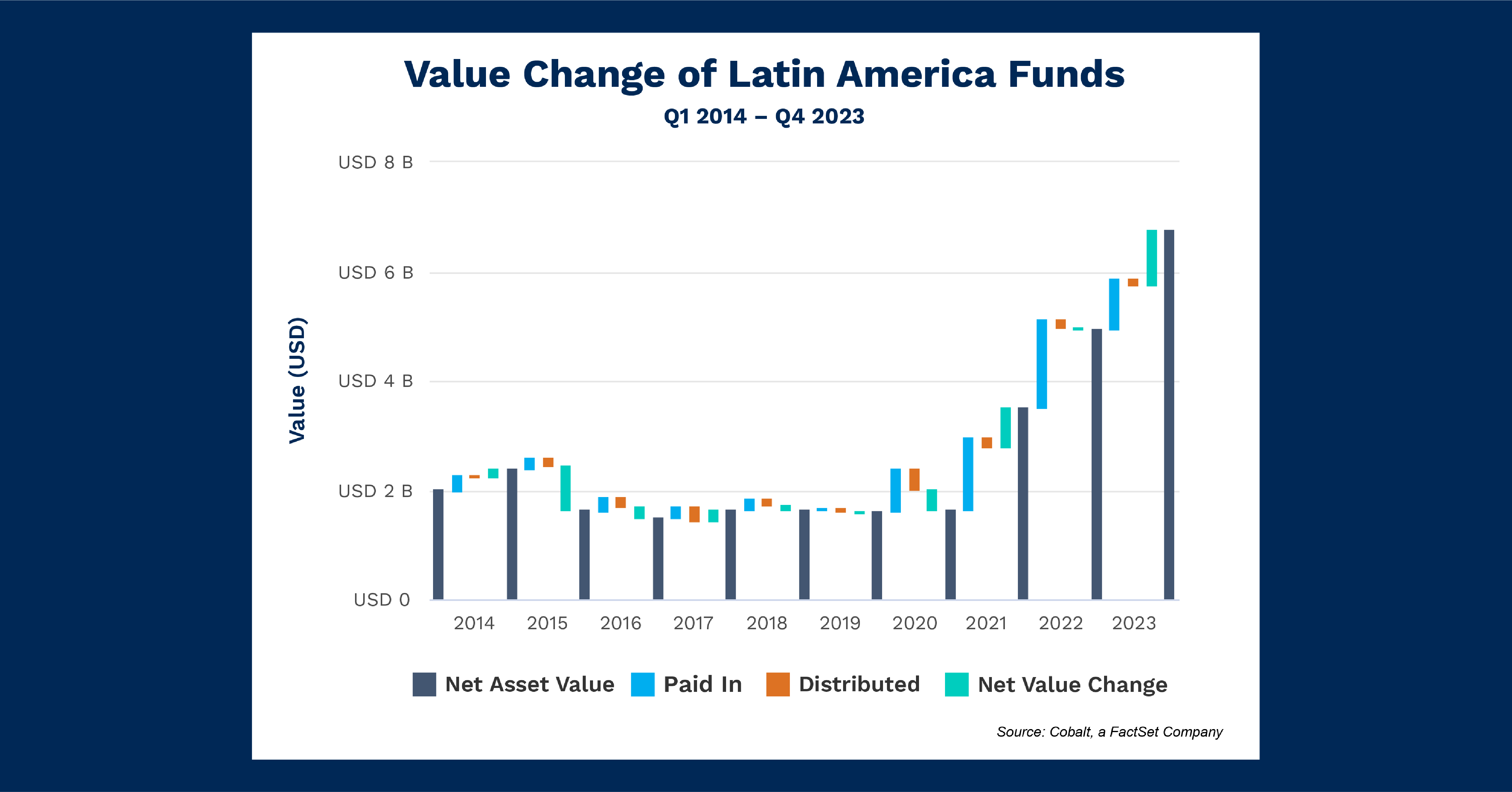

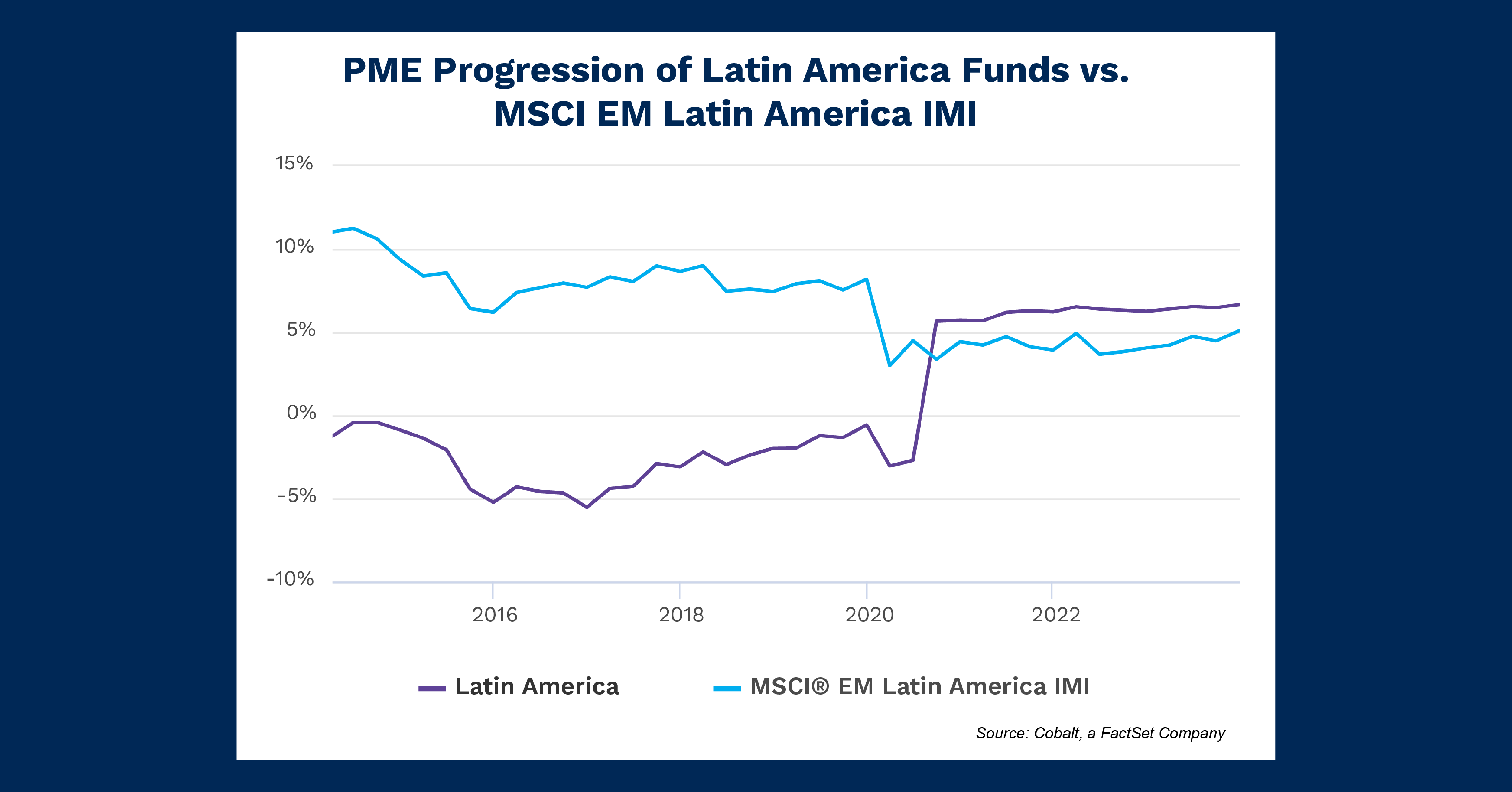

The charts below represent a portfolio of Latin America fund performance. We display both value change and return to capture private markets and placed that against the overall public market return for the region to discern potential correlation to a public market effect.

Key Takeaways

To establish the list of elections we looked at Brazil (Q4 2018, 2022), Mexico (Q3 2018, 2024), Argentina (Q4 2015, 2019, 2023), and Colombia (Q2 2018, 2022). As the four largest economies in Latin America, they comprise the majority of private investment interest within our dataset.

Q4 2016 – Q1 2017 saw significant contributions, and Q1 2023 saw significant distributions. While a change in power did occur in Brazil in Q4 2016, it was mired in weak sentiment and was unlikely to have lifted investment interest. Q1 2023 also does not coincide with any election, and therefore may instead reflect the eventual distribution of funds invested in 2020 given how three years of the highly profitable deep-value investments of 2020 may have begun to pay off.

Q3 2020 delivered a reversal of the private and public market returns as the private market return jumped from a negative to around 5%, while the public market returns dropped from around 8% to 3% over the same time period. This doesn’t seem to correlate with any of the election timelines. It could easily be a combination of public market drawdowns from pandemic shutdowns combined with large returns from a small group of funds floating the private market returns.

Looking Ahead

Late July saw a heavily scrutinized election in Venezuela: A country that has historically had significant impact on oil pricing, but a smaller overall economy. This will likely have significant effects on local markets, but it’s too soon to evaluate if the election will impact investment interest at a regional level. Overall, however, our analysis within Cobalt’s market data set tells us it’s difficult to predict the impact of presidential results on public or private markets above the level of mere market noise.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…