blog

Chart of the Month: July 2021

July 2, 2021

The Tortoise and the Hare: An Examination of the Two Styles Driving Healthcare and Tech Investing

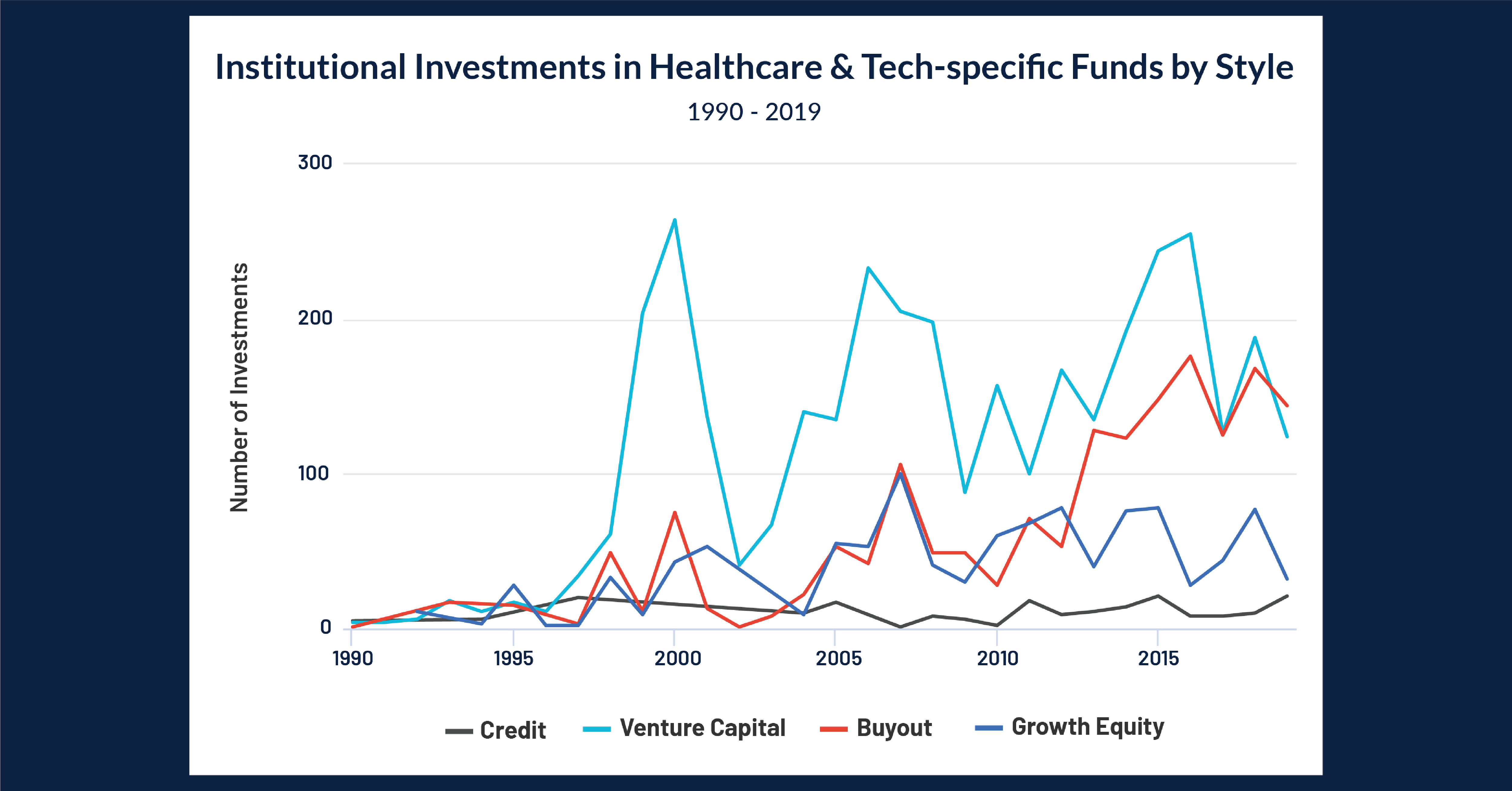

This month, we examined institutional interest in the Healthcare & Technology sectors from 1990 to 2019. We used Cobalt Market Data to break out our Limited Partner investments into these sectors by investment style in order to see the trends that emerge within each specific style.

Key Takeaways:

- Though there seems to be cyclical interest in these sector-specific investments, the general trend is upward, illustrated by the 3-year average total investments per year of the main peaks (most evident in the VC trendline) over the past 20 years: 1999-2001; 272 Investments / year, 2006-2008; 351, 2014-2016; 465. This shows that institutions are impacted by external market factors that may cause the cyclical demand, but overall, the appetite for sector-specific funds has been growing since the turn of the century.

- Interestingly, 2019 was the first vintage year in which sector-specific buyout funds surpassed venture funds in total investments since the early 90’s, when total investments in these funds was significantly lower. We also can observe that Buyouts have been steadily growing since the early 2000’s, while venture tends to react more cyclically around greater market events such as the Dot Com Bubble and Great Recession.

- Two factors may be working in tandem to cause this uptrend. First, institutions may be turning more to sector-specific funds as an attractive tool for portfolio diversification, creating demand for more investments in the space. On the other side, Buyout firms are raising more sector-specific funds or starting out as sector-specific shops as another way to differentiate and create competitive outperformance in the overall buyout space. With more capital invested in the space and more landing spots for that capital, the steady rise in the buyout space over the past two decades begins to make sense.

Looking Ahead

- Strictly based off of the historical chart pattern, Venture Capital investments look ready to reverse trend and approach the highs seen in 2000, 2007, and 2015 again. As well, the macro event of the pandemic last year may be the catalyst for higher venture investments, as healthcare will be a popular space in the coming half-decade.

- Based off of past market events, this may have a more muted effect on buyouts, but we would still expect these funds to benefit as well and continue their uptrend that has been especially strong since 2010.

Subscribe to our blog:

More Blog Posts

April 19, 2024

Chart of the Month: April 2024

Surge Pricing: Examining the Ability to Adjust North America Infrastructure Investing on a Short Timeline The state of Infrastructure investing…

March 18, 2024

Chart of the Month: March 2024

Law of Averages: Comparing 3 Decades of Commitments Among Buyout, Venture Capital, and Credit Funds In private markets, we regularly…

March 8, 2024

Cobalt Expands Data Regions: A Step Forward in Addressing Data Residency Concerns while Ensuring Security, Privacy, and Control

Cobalt Expands Data Regions: A Step Forward in Addressing Data Residency Concerns while Ensuring Security, Privacy, and Control At Cobalt,…