Chart of the Month: October 2023

More BRICS in the Wall: Analyzing the Effect of Currency Choice on Fund Performance

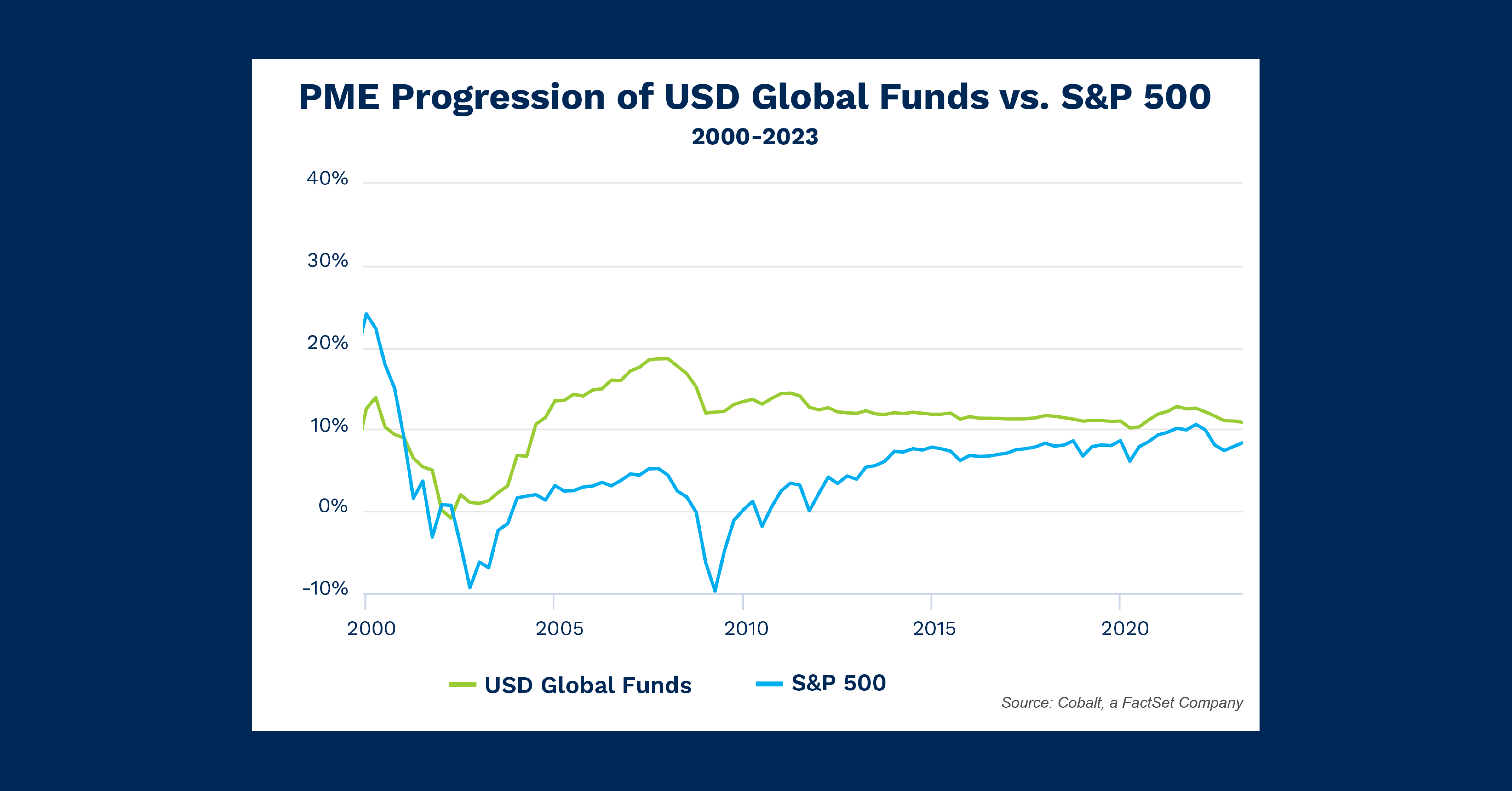

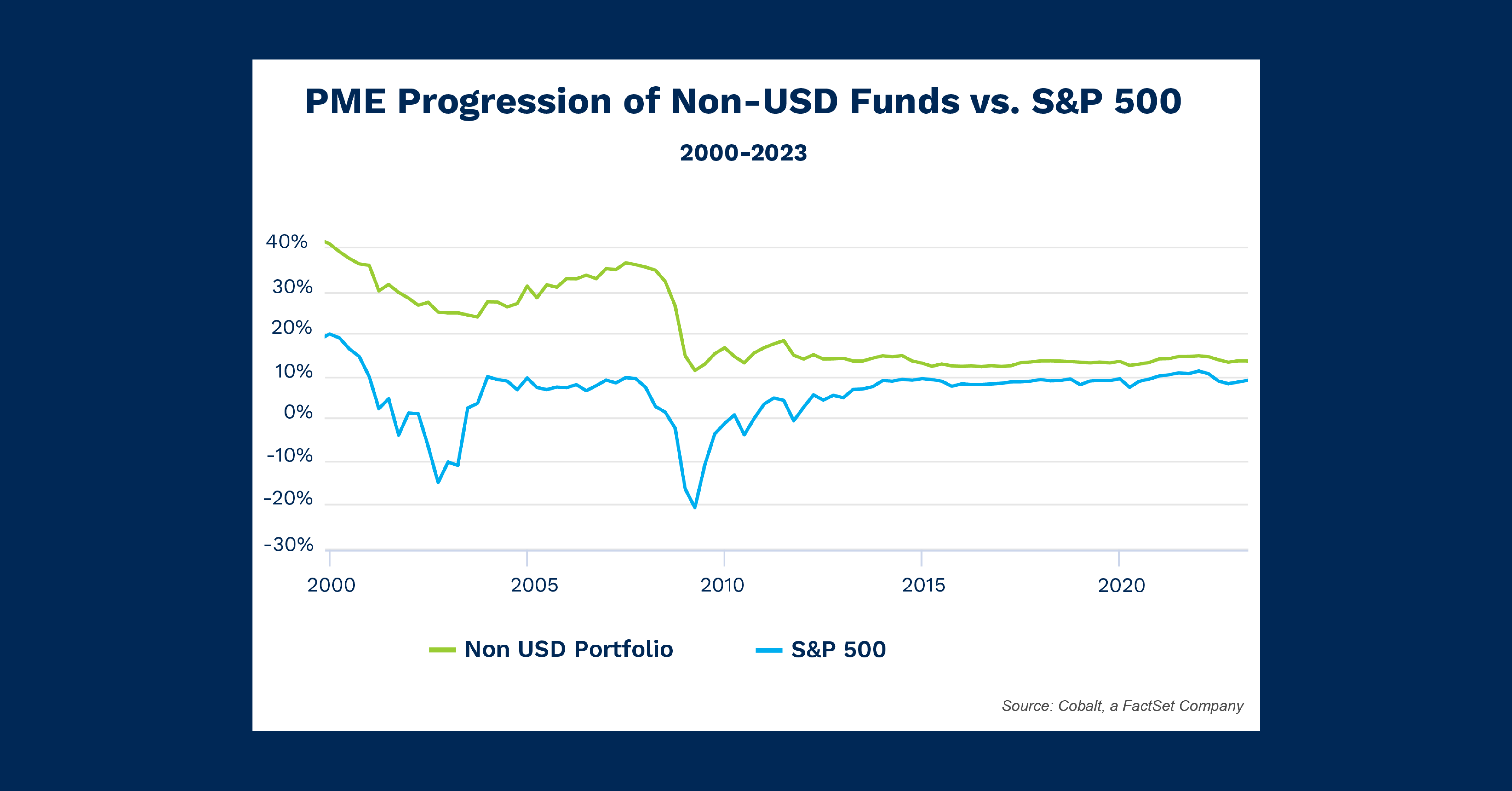

In light of the recent BRICS summit and the group’s goal of de-dollarization, we explored the effects of currency choice on global private market investing via two representative portfolios:

- USD funds investing outside of the US

- Non-USD funds investing across the globe

We then compared each to the S&P 500 to see how they perform relative to the American public market equivalent (PME).

Key Takeaways

Looking at the charts, the two portfolios display largely similar characteristics overall. Both progressions peaked in 2000 and cratered shortly after, reflecting the crash following the dot–com bubble. Then, we see positive progression again through the mid–2000s until a crash during the financial crisis of 2007-2008. Finally, investors received a calm tailwind to finish the 2010s with a safe and consistent outperformance of the S&P 500 at around 10%.

The non-USD portfolio generated a much higher average level of returns than the USD sample for the bulk of the 2000s, and then leveled to the USD group around the Great Recession. But what caused non-USD funds to outperform their dollar-denominated counterparts throughout the mid 2000s?

The performance of the Euro may be one factor. Euro-denominated funds make up a large portion of the non-USD portfolio, and that currency exhibited strengthening compared to the USD over that period. Another explanation may be European market outperformance during that period. Indices, including the FTSE 350, expanded close to 2x from trough to peak progression in the mid-2000s, while the S&P 500 only expanded around 1.5x during the same period.

Looking Ahead

It will be important to keep in mind U.K.’s continued struggles with inflation when observing the next trends in Western Europe. Most other major economies have reduced or muted the effects of inflation at this point, while the U.K. may still be mired in a macro climate that’s less friendly to alternative returns.

With a more volatile environment, it will be interesting to see if the unexpected observations in the venture capital and buyout lower quartile returns revert back to the average benchmark moving forward.

Subscribe to our blog:

Chart of the Month: June 2024

Silicon Safari: Examining the Trajectory of Sub-Saharan Investment Trends In May, the US hosted Kenya President William Ruto as part…

How Five Points Capital Assesses the Exposure and Returns of a Complex Portfolio with Cobalt Portfolio Monitoring

CLIENT CASE STUDY How Five Points Capital Gained Efficiency and Accuracy with Cobalt In this case study, Patrick O’Rourke,…

Chart of the Month: May 2024

Derivative Charts: Plotting the Growth of the Alternatives Market Following up on last month’s chart and the exploration of our off-platform data…