Chart of the Month: November 2023

Playing the Long Game: Comparing VC & Buyouts Across Different Time Horizons

Within private markets, there’s often a focus on core metrics such as internal rates of return, multiples, and public market equivalents. However, Cobalt’s dataset collects cash flow information that enables users to derive metrics such as the time-weighted rate of return (TWRR) for a group of funds.

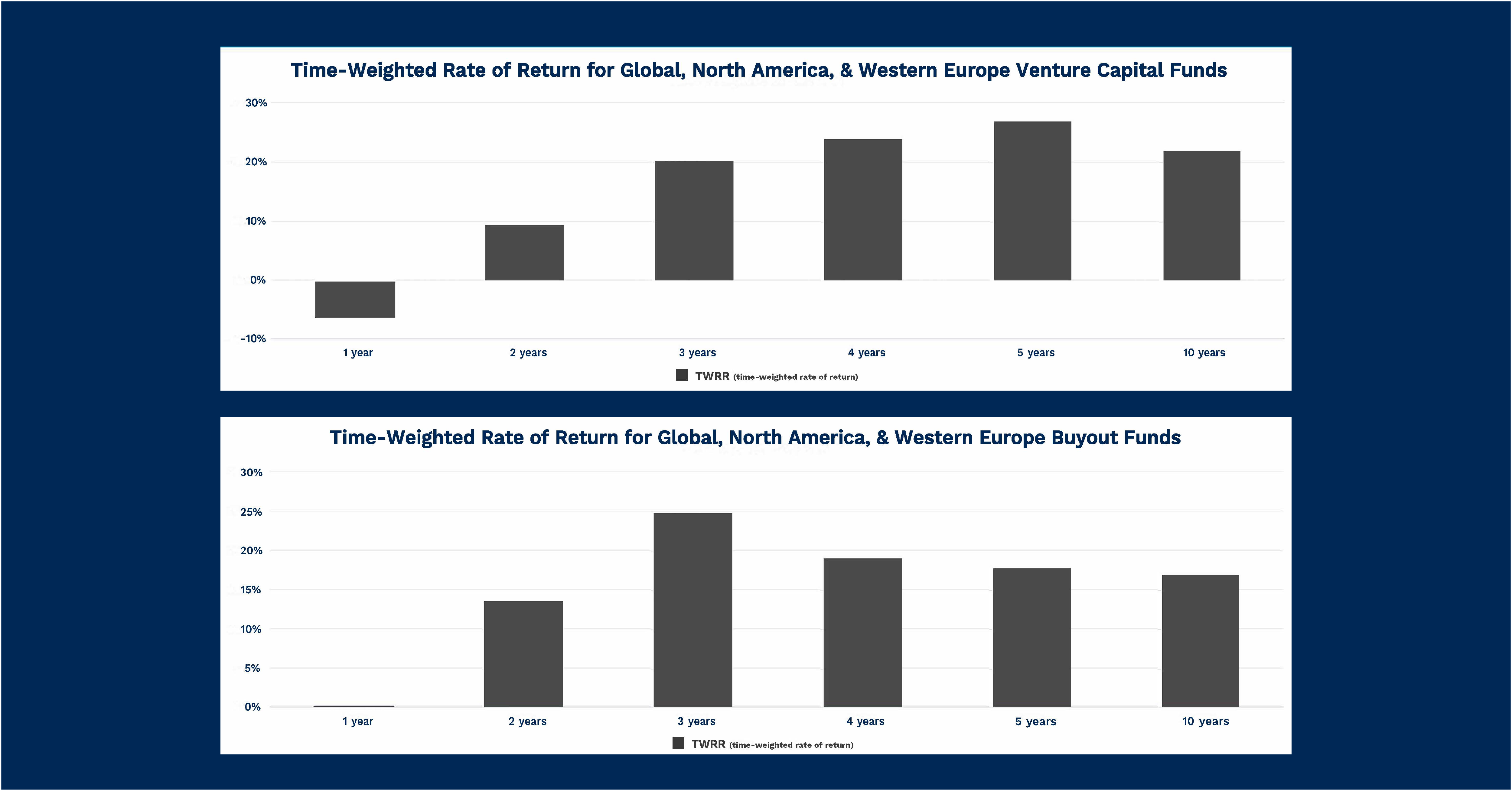

To highlight this metric, the chart below illustrates TWRR for the North American, Global, and Western Europe markets to compare the regions’ buyout and venture capital (VC) funds across different time horizons.

Key Takeaways

At first glance when comparing the two charts, the different patterns the VC and buyout funds take across each time horizon stand out most. The VC curve shows a slow decrease year-over-year, while buyout returns increase from the 10-year horizon, peaking at the 3-year horizon with a large increase. This spike can most likely be attributed to the timing of the chart, with a 3-year horizon starting in March 2020 (the bottom of the markets during the pandemic).

Another time period that jumps out is the negative venture capital returns at the 1-year horizon. We’ve covered many of the macro factors (including our analysis of first quarter 2023), but increasing interest rates and bank scares at the beginning of 2023 (SVB in particular) created a tough environment for VC on the 1-year timeframe.

A closer comparison of the two charts shows an emerging trend: VC generated higher performance on the 4-, 5-, and 10-year horizons, while Buyouts outperformed over the past 3 years. While VC had the stronger run throughout the relatively stable 2010s, it seems Buyouts are better suited for the uncertain financial climate and volatility that has defined the beginning of the 2020s.

Looking Ahead

Given this current trend, you might expect buyout funds to be a stronger investment in coming quarters. While each investment style has a higher rate of return for 3 horizons, venture capital’s outperformance lasted over 6 years. If this trend holds, Buyout investments still have a few more years remaining as the top performer. However, with so many unknowns and looming issues in the macro environment, it would not be surprising to see a quicker reversal of fortune.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…