Cobalt Chart of the Month: May 2021

Outpacing the Rising Tide: An Examination of the 2015 Distressed Credit Crash

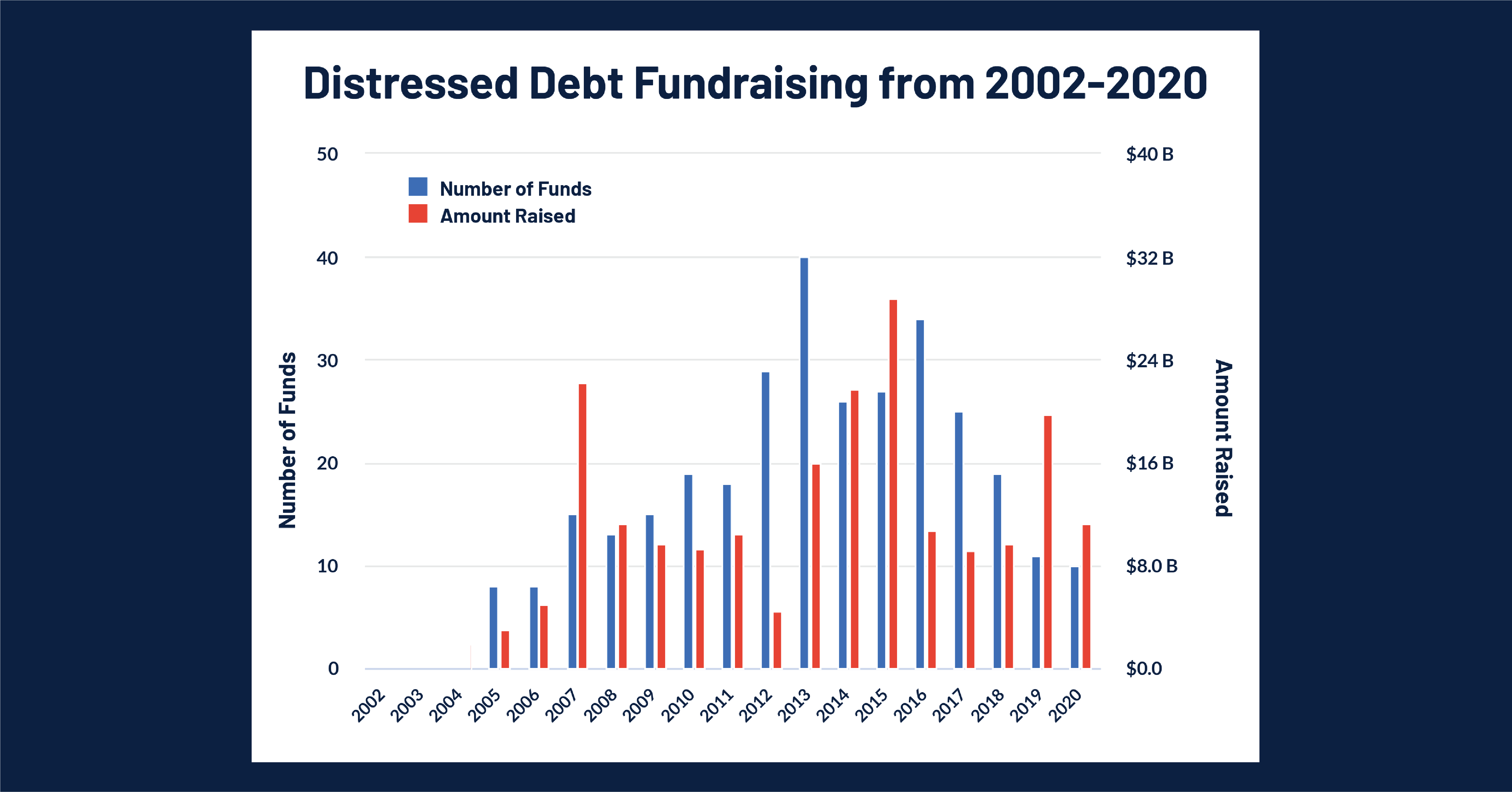

As evidence of inflation and concerns over future yields amidst the economy recovery have begun to emerge, we used Cobalt Market Data to look at an example of yield-driven frenzy that built in the wake of the last recession. We examined the distressed credit bubble on the mid 2010’s and the impact on fundraising efforts from 2002 until 2020.

Key Takeaways:

- 2015 was a tumultuous year for distressed debt investors. Distressed credit vehicles achieved a record fundraising year of $29 billion, exceeding fundraising efforts in 2007, the previous all-time high vintage year, by $7 billion. The distressed debt frenzy of 2015 followed years of very low interest rates in a correction effort to quell the effects of the recession.

- The movement to distressed debt became strong in 2013, with traditional investments in 2012 trailing expectations. Investors looking for high-risk, high-reward investments in 2015 and the two years before were turning to distressed debt vehicles of all kinds, including mutual funds and hedge funds that were placing bets on risky junk bonds and credit held by companies facing impending bankruptcy.

- Because of the illiquidity of high yield debt, sliding commodity prices, and high corporate debt default rates, the high yield investment funds began to experience mass capital recalls from investors. Total fundraising for these funds went from about $29 billion to $10 billion and under for the years 2016-2018, until 2019. 2019 distressed debt funds followed a very similar pattern to 2007 funds, raising approximately $20 billion. The crash of distressed debt vehicles coincided with the slowdown of the US economy, which had grown 3.9% in the second quarter of 2015, but only 0.7% in the fourth quarter.

Looking Ahead

- The federal reserve is expecting GDP growth and strong economic conditions in the coming future but has not yet raised interest rates. Inflation is expected to rise, pushing up the yields on the 10-year treasury note quite rapidly, mirroring patterns in yield raises experienced after the 2008 recession.

- Today, the near-zero interest rates, rising inflation, and the backlash of rising treasury yields may create a similar circumstance to the distressed debt frenzy in 2015. The distressed debt market experiences long, multi-year cycles that correlate with economic prosperity. It will be interesting to see if investors in 5 years will look to more volatile, risky investments to produce returns that could not be achieved in the stock market. These economic factors could indicate the plateau and recession of high growth high yield stocks, pushing investors into low-risk investments with slow and steady returns.

- On the other end, investors in 2015 and the two previous years learned the hard way that these investments can be very illiquid, and returns may disappear before principle or interest are returned to the investors. With the rise of crypto trading and other unorthodox yet potentially lucrative investing, investors may flock to these new opportunities to beat lagging market returns.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…