2020 Forecast in The Shredder? It’s Time to Automate

If you are focused on producing and (constantly) updating forecasts for your firm right now, you are not alone. In the midst of uncertainty driven by the coronavirus, many private equity and venture capital firms are more closely monitoring portfolio health, asking:

- Which of our portfolio companies need cash, NOW?

- Which ones can stand on their own two feet longer?

- Can / should we reallocate resources to support our portfolio companies’ health?

Forecasting isn’t new to the private markets, and during a market dislocation, this shorter-term financial watch and responsive reallocation strategy is the smartest move.

“Good forecasting hygiene supports the stability play that, in theory, every private equity firm should have in their strategic playbook,” says Cobalt CEO Jason Weinstein. “With COVID-19, we’ve seen many firms issue an entirely new set of scenarios to account for updated definitions of ‘bad, worse, and worst.’”

So what should your forecasting report include? Let’s take a look.

Anatomy of a Good Private Equity Forecast

Most forecasting reports account for some combination of the following metrics:

Most forecasting reports account for some combination of the following metrics:

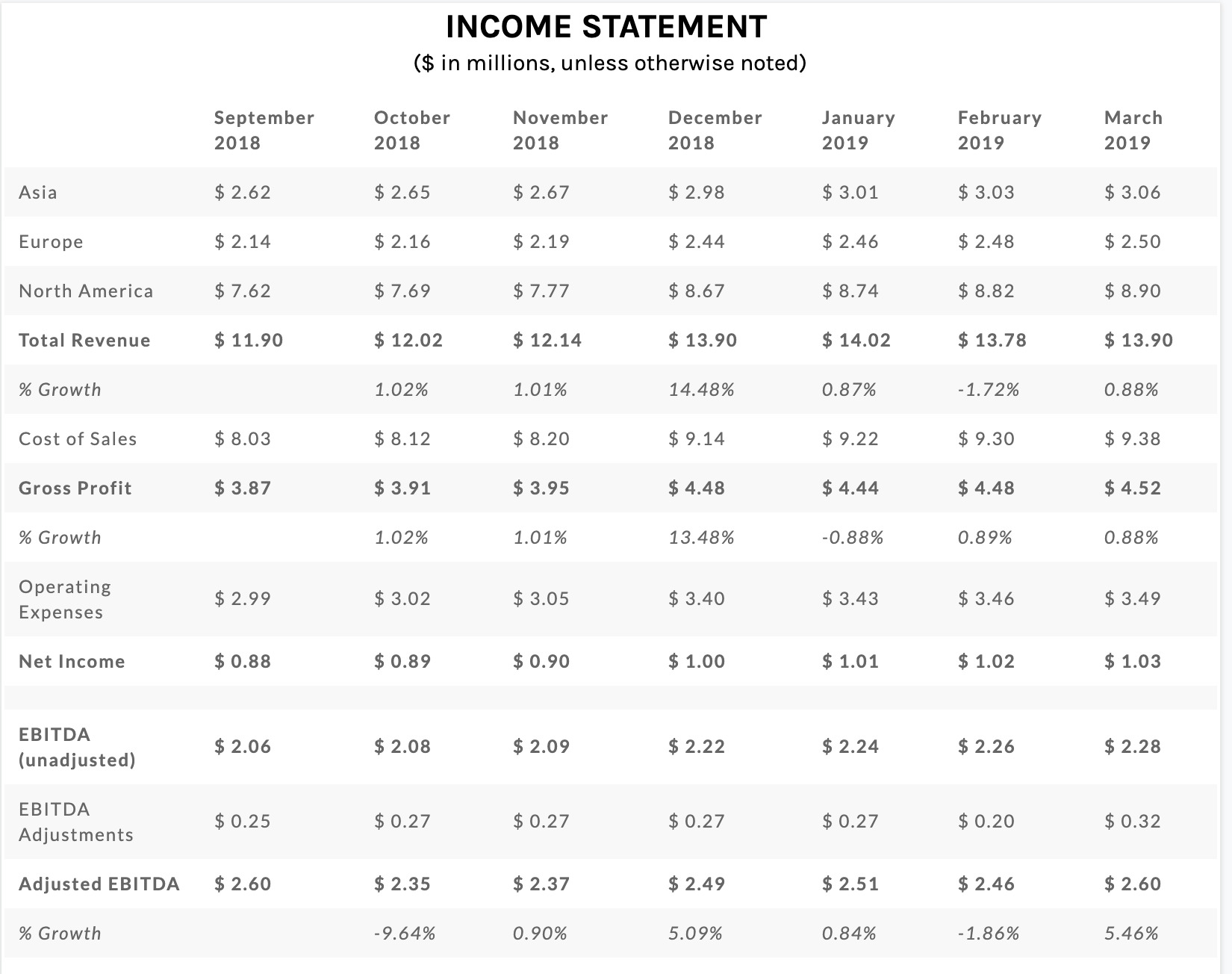

- Cash flows: How often do you update your cash flow and income statements to stay on top of the numbers?

- Employee growth: How will your portfolio company’s workforce grow (or shrink) in the next 30-180 days?

- ESG metrics: What will your cost of energy be in the next month? What about water use? Impact to your portfolio company’s surrounding communities in any shift?

- Additional investments and/or alternative capital: Where do you anticipate making additional investments? Do you plan on issuing debt or applying a new structure to your investment?

As with everything, forecasting is not a “one-and-done” process. Best practice dictates that they be updated on a regular basis, to account for material changes to any of these metrics.

Source: Cobalt GP

A More Efficient Way to Forecast

Private equity reporting can be an onerous and time-consuming task: LP and management requests for information are more frequent and detailed than ever — and then there are the tools you use to produce them.In order to efficiently and easily manage your forecasts, you’ll likely want to pull forecasts together from one centralized system. This is all the more critical as team members collaborate from afar.

Solutions you’ll want to consider will include these critical features, automated:

Solutions you’ll want to consider will include these critical features, automated:

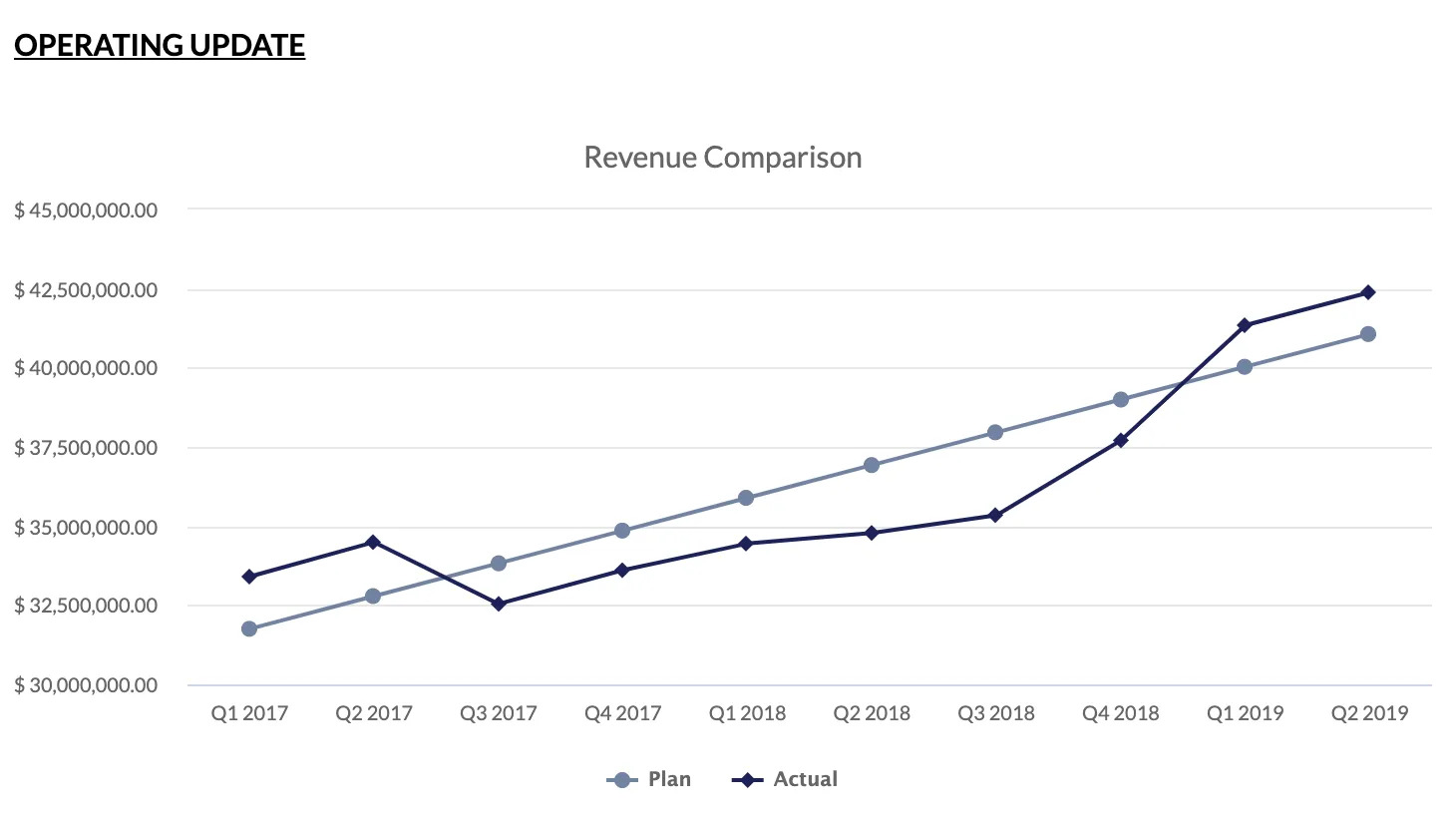

- Metrics versions to uniquely compare actual versus projected KPIs (i.e. Revenue, EBITDA, Income). A good solution will allow you to graph metrics versions automatically and in real-time.

- Variance analysis, so that you can compare actual metrics versus a selection of scenarios, whether those are investment cases, high-/mid-/low-risk scenarios, or even outcomes based on whether a vaccine to COVID-19 is developed in 6, 12, or 18 months.

- A “Dashboard View” so that you can see, in one shot, the critical information you need to know at the click of a button, including how much longer a given portfolio company can operate with cash on hand, and quick-take calculations on key scenarios (i.e. workforce distribution shifts or production slow-downs).

- Sharing for easy, remote team collaboration, and even export to PDF for quick-turnaround distribution to management and LPs.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…