Personalized Dashboards: The Operations Team

The Private Equity Operations Team needs a way to show management that the Deal Team is executing on their value creation plan and that the firm’s portfolio continues to grow. In the dashboard below, we’ve included key financial elements that every operations team should include as they prep reports for quarterly portfolio meetings.

Key elements of our best-practice dashboard for the growth-focused Operations Team include:

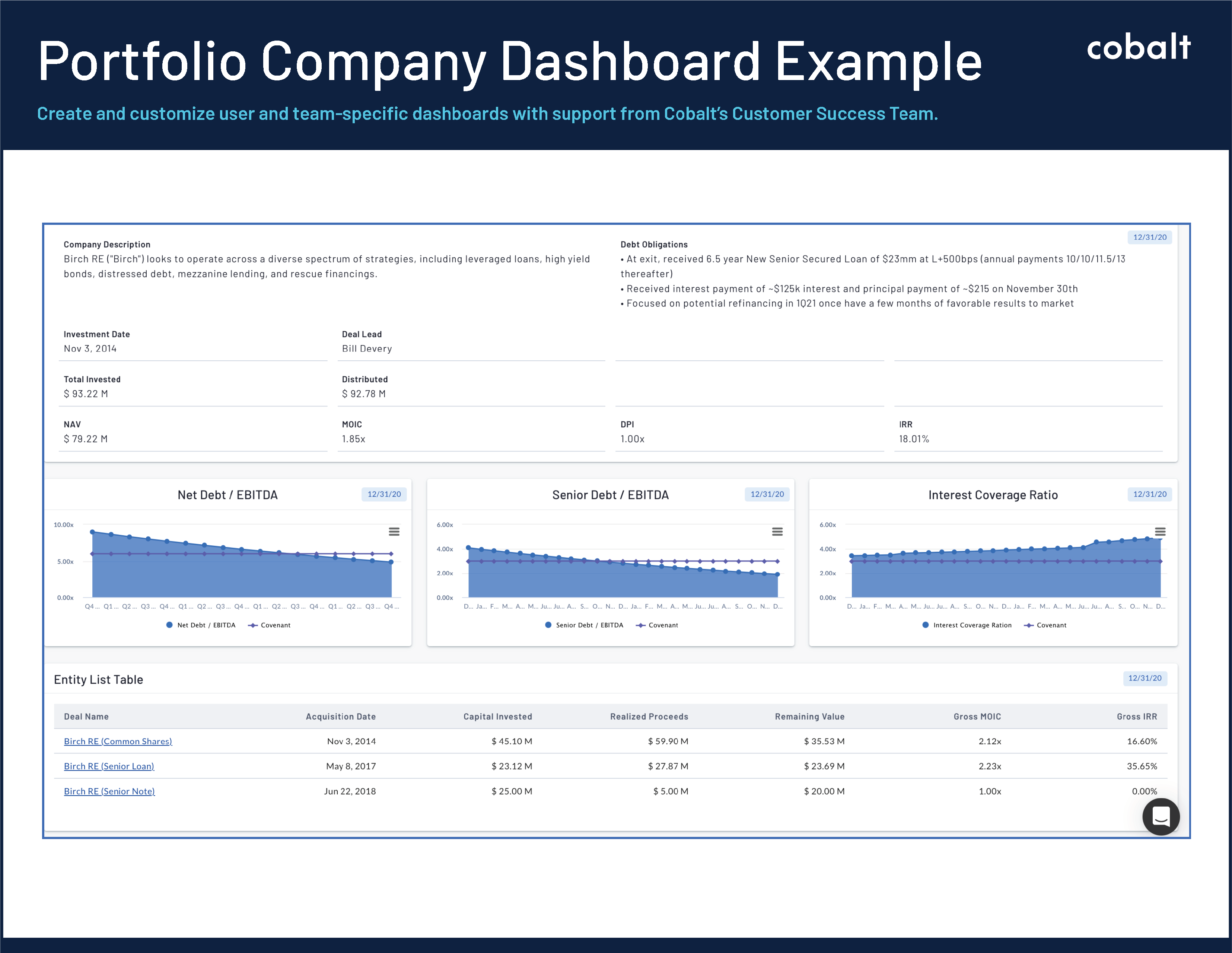

- Portfolio Company Overview which includes fully-editable text fields for the company description, deal team lead, and debt obligations. This dashboard also pulls in calculated performance metrics such as NAV, MOIC, DPI, and IRR.

- Net Debt / EBITDA and Senior Debt / EBITDA being shown comparatively against their covenants. Whether it is budget numbers or covenants vs. your actuals; being able to show multiple versions of metrics across your portfolio companies in chart format is highly beneficial.

- Interest Coverage Ratio is similar to the above, but takes advantage of Cobalt’s unique ability to create calculated metrics (EBIT / Interest Expense = Interest Coverage Ratio) and apply that to dashboards.

- Entity List Table showing related deals and their key information like acquisition date, capital invested, realized proceeds, remaining value, and gross MOIC and IRR.

Cobalt’s Portfolio Monitoring platform gives you the ability to personalize team and user-specific dashboards that are in-sync with the way your firm operates and reports performance. Users can create and customize dashboards on the fly and then easily export to professional, pixel-perfect PDFs that are always partner-ready. Request a demo of Cobalt’s dashboard capabilities today.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…