Personalized Dashboards: The Investor Relations Team

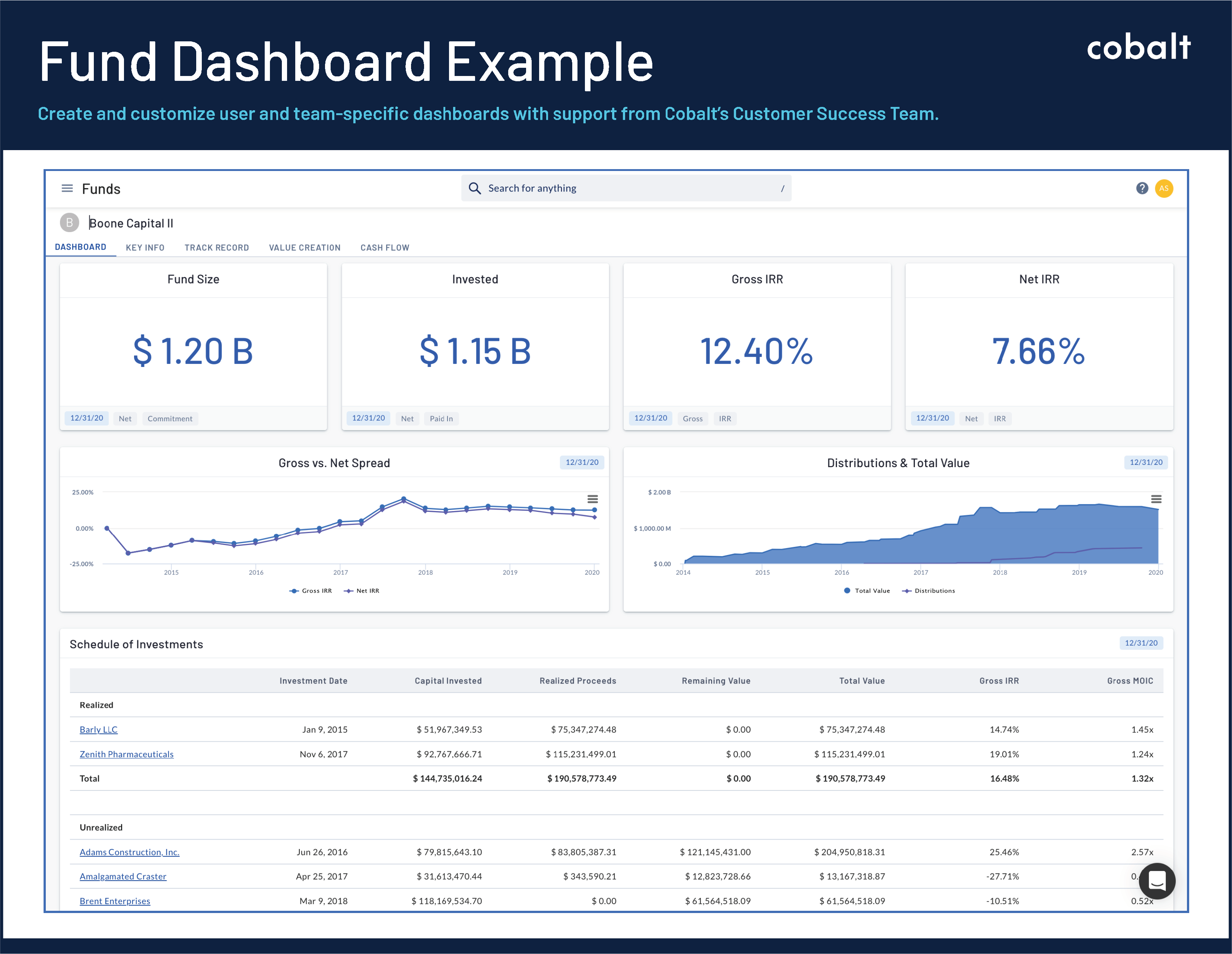

Investor Relations professionals play a big role in satisfying LP requests and inquiries surrounding overall fund performance. Any IR Team needs to be able to quickly produce a professional report with up-to-date fund metrics and cash flow information. We created the dashboard below on Cobalt’s Portfolio Monitoring platform to include key reporting elements that capture big-picture fund performance for inquiring partners and investors.

Key elements of our best-practice dashboard for the Investor Relations team include:

- Key metric values including fund size, invested capital, gross and net IRR. High-level fund performance indicators give a quick snapshot of the funds performance.

- Gross IRR vs. Net IRR Spread: When reporting to investors, it’s important to show both the IRR associated with the cash flows from investors to fund, as well as the cash flows from fund to portfolio companies.

- Distributions & Total Value graph gives you an accurate timeline of when distributions are being made compared to the fund’s total value.

- Schedule of Investments Table: the ability to seamlessly produce SOIs, organized by realized vs. unrealized, allows you to clearly visualize the performance of each investment and see the overall status of the fund.

Cobalt’s Portfolio Monitoring platform gives you the ability to personalize team and user-specific dashboards that are in-sync with the way your firm operates and reports performance. Users can create and customize dashboards on the fly and then easily export to professional, pixel-perfect PDFs that are always partner-ready. Request a demo of Cobalt’s dashboard capabilities today.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…