Chart of the Month: October 2022

In for a Penny: Comparing FTSE Performance Against Various Private Market Geographies

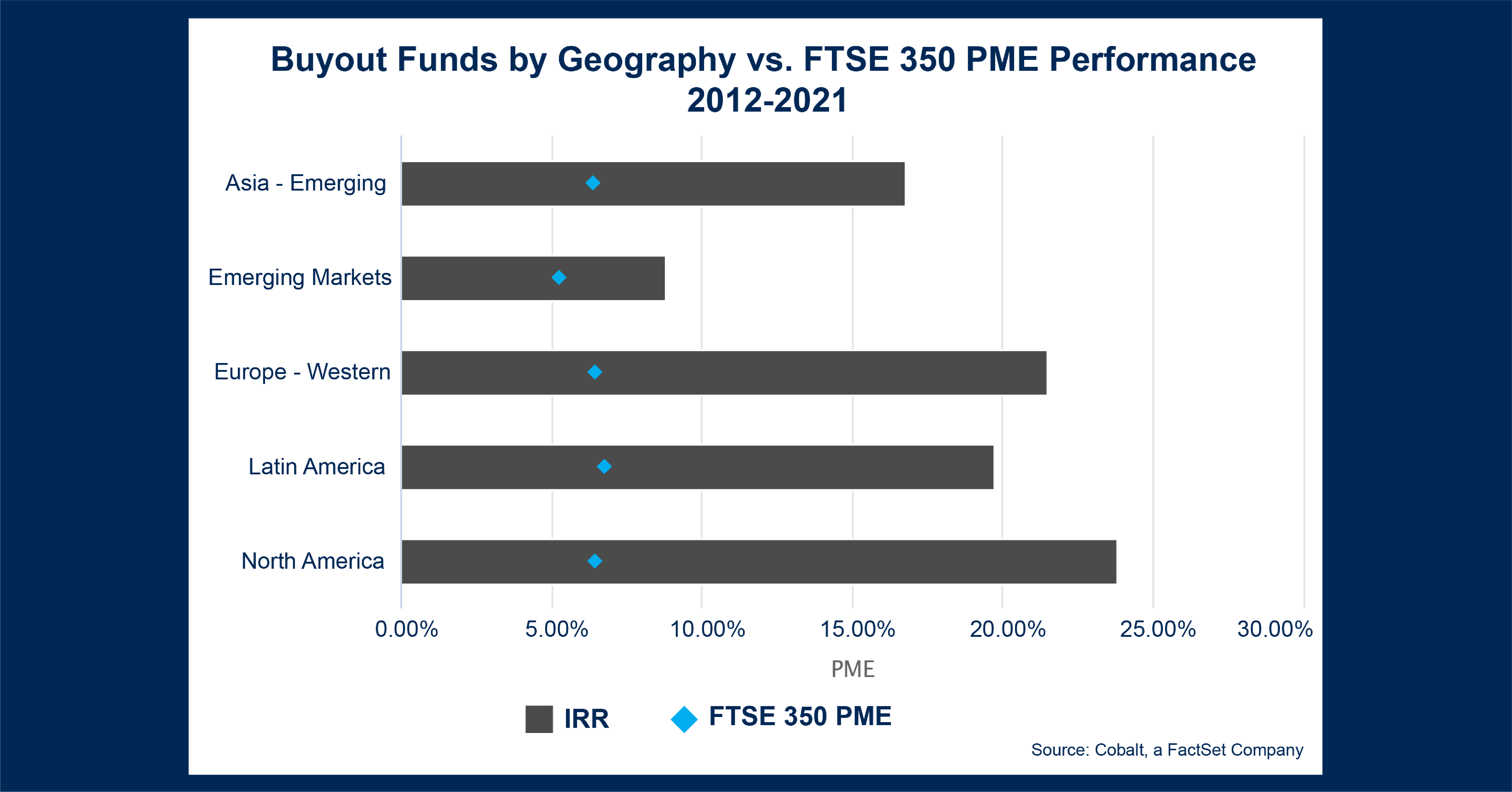

Last month, pundits boldly claimed that the United Kingdom is being viewed as an emerging market nation. While this may exaggerate their current economic status, many were perturbed by the UK’s budget plan (released amidst political turnover and energy crises), and reactions simultaneously lowered GBP valuations while raising government bond yields. Such a combination often indicates supremely low confidence in the government. Thus, we ask: how does this connect to private markets? This month’s chart uses the FTSE 350 as a proxy for historical public market sentiment of the UK in comparison to Cobalt’s in-house PME calculation to see if any notable comparisons could be drawn across various geographies in the past decade.

Please note: “Emerging Markets” refers to any private fund that invests in Emerging Markets across the globe, rather than a particular region.

Key Takeaways:

- In the chart above, ‘Europe – Western’ acts as a proxy for UK Buyout performance. Unsurprisingly, ‘European Buyout’ offers a premium to public market performance over that period. Even though the European funds contain more nations and funds than just British ones, it still convincingly shows private market outperformance by that region’s funds. ‘North America’ also delivered similar levels of outperformance. While not all developed regions will deliver identical returns, they will likely deliver outperformance over public markets regardless of which developed region is chosen.

- Two examples of emerging market funds are presented in ‘Asia – Emerging’ and ‘Latin America’. In both examples, the reader can once again see consistent outperformance by private markets compared to the FTSE public benchmark. Despite lacking much of the deal infrastructure enjoyed by developed markets, the opportunity for growth and rapidly increased investment into these regions over the past decade allow for the significant outperformance seen here.

- Finally, funds that are invested across the emerging market display the weakest overall performance. Ironically, the FTSE shows the closest return to the private emerging market landscape. However, this says more about the overall risk/return profile of emerging markets than public market performance and should caution that regional diversity does not inherently improve performance.

Looking Ahead:

- As the British markets roil forward, European private markets will likely continue to demonstrate outperformance over their public counterparts. Moreover, if British public securities, bonds, and currency conditions continue to worsen, we may see greater investment into private markets across the globe.

- Even emerging markets may see improvement. While the British economy may not truly be an emerging market, the decreased demand for its assets and the ever-increasing funding and infrastructure funneling into emerging opportunities may push further outperformance there, even in areas where present outperformance is less significant.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…