Chart of the Month: November 2022

On the World’s Stage: The Middle East & Growth in the 21st century

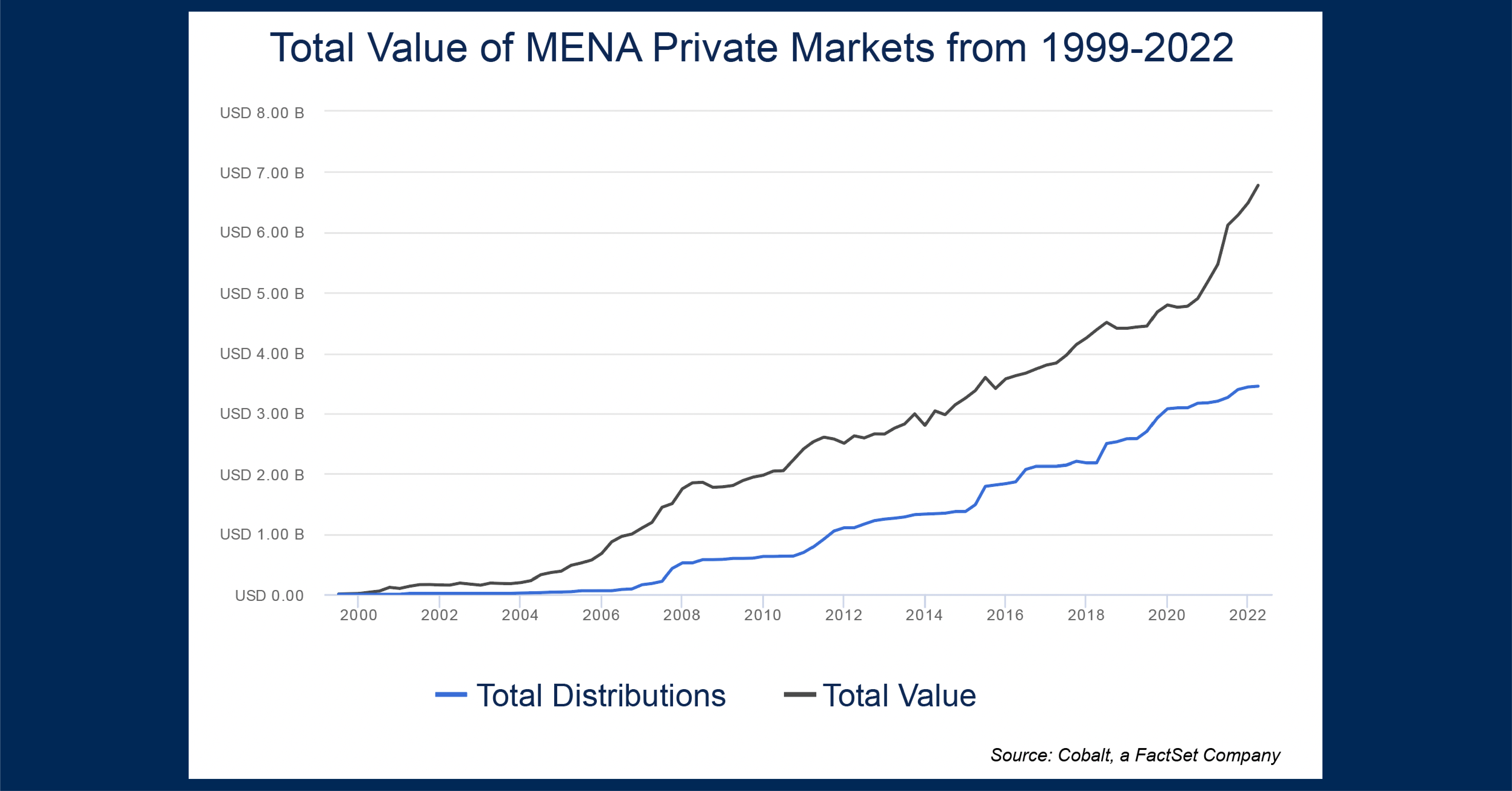

The World Cup is set to kick off later this month in Qatar and with it, global attention to the country and region will shift over the next 2 months. Therefore, this month’s chart examines the region from a private markets performance perspective. As a follow-up to the dive into Emerging Markets this past July, we’re doubling-down on MENA (Middle East & Northern Africa) funds and analyzing the growth of the market through both the NAV and distributions of the underlying funds.

Key Takeaways:

- Total Value in MENA hit an all-time high of $6.8 Billion to start 2022. This high value trend continued every quarter since Q1 2020, much in line with the rest of the economy’s upward trajectory after the initial COVID-19 shutdown in March 2020. In MENA, this was driven mostly on the NAV side, signaling that it was new LP commitments and growing investments that have caused the recent upturn.

- The recent rise in NAV also brought the market nearly in-line with distributions for the region ($3.33 B and $3.45 B respectively). This marks the first time since 2018 that both cash flows were in line, as distributions rose steadily throughout the 2010’s. These trends begin to make sense as we look further back into the 2000’s in the region.

- From 1999-2007, the Total Value of the region was almost exclusively tied to the NAV of the underlying funds. Only from 2008 onwards do we see significant distributions. This will often be the case for a nascent, emerging market, as the fund lifecycle may take over five years to produce pertinent returns. The steady growth of distributions in the 2010’s then makes sense as a result of a more maturing market bearing more success.

Looking Ahead:

- As mentioned in our last Emerging Markets piece, the structure and opportunity in the Middle East bodes well for continuing the growth trends in the area (Venture Capital specifically). However, as we know the macroeconomic climate has been changing recently, in the short term we shouldn’t expect the vertical line growth seen over the past few quarters.

- One thing to keep an eye out for will be to see if the recent influx of NAV will bear out another run of substantial distributions in the years to come.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…