Cobalt Chart of the Month: November 2020

Cobalt Market Data / Chart of the Month

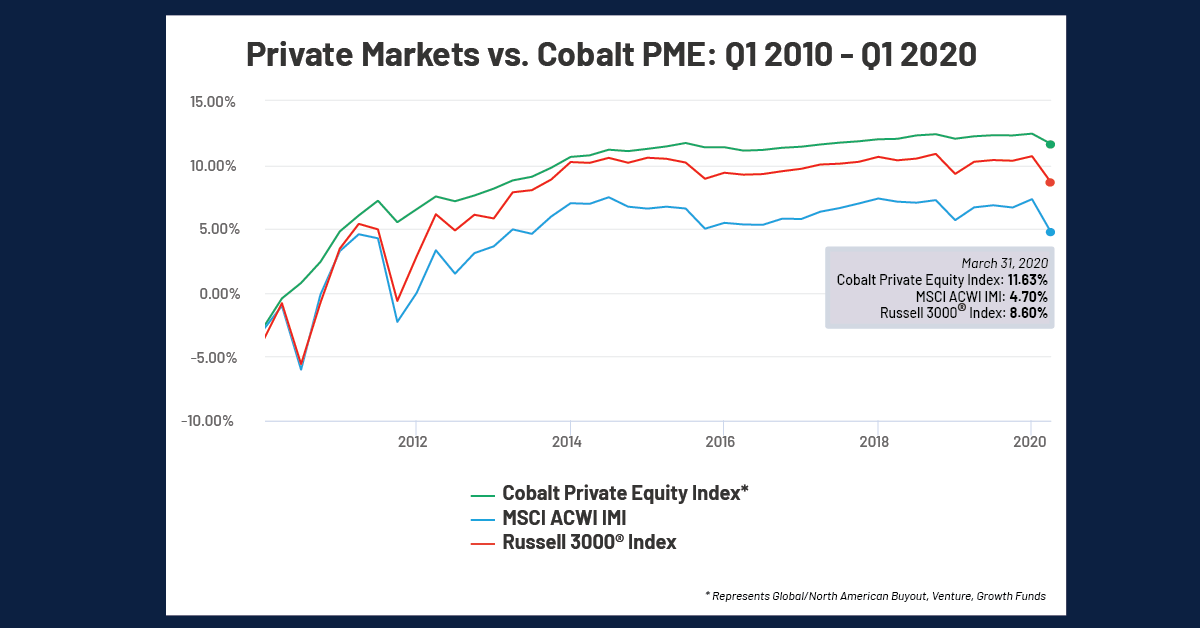

The Cobalt Research team recently pushed its Q1 2020 private equity benchmark to the Cobalt platform. With this dataset at our fingertips, we’re taking a look back at how the private markets fared during the economic turmoil of the first quarter this year.

In order to gauge how private equity performed in Q1, we analyzed a basket of funds (Cobalt Private Equity Index) comprised of Global and North America buyout, venture, and growth funds from 2005-2020, and compared it to the MSCI ACWI and Russell 3000® Index using the Cobalt PME methodology.

Q1 2020 Analysis: Looking back at PME trends from the past decade

Key Takeaways:

- The public market indexes followed similar patterns over the observed period, experiencing sharp volatility from 2010-2012, and showing the same drawdown in Q1 2020.

- PE not only outperformed the public markets consistently through the period but also saw less drastic downturns both at the beginning of the decade and earlier this year, with the IRR down in Q1 from 12.44% in Q4 2019. By comparison, the MSCI ACWI and Russell 3000® Indexes saw downturns of 2.62% and 2.08% respectively from the previous quarter.

- Private equity’s lowered volatility, paired with its overall outperformance, made it a more attractive investment vehicle compared to the public markets in the 2010s, as a ‘higher floor, higher ceiling’ play. This continued to be the case in the early days of the COVID crisis, as private equity returns remained more consistent through the 1st quarter of the year.

Looking Ahead

- Generally speaking, the long-term horizons of private equity make it less volatile compared to the public markets. In the past this has meant institutional investors have increased their interest in PE during economic downturns, seeing it as an effective diversification mechanism.

- We will be looking over the next few quarters to see if the trends from previous recoveries hold true as the markets navigate COVID. If history does repeat, we should expect performance to be more steady among PE in the coming years, along with an uptick in commitments to private equity funds.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…