Chart of the Month: January 2024

Perfectly Hedged? Questioning the Tether Between Private Credit and the Federal Funds Rate

Akin to Steve Eisman’s critique of how a firm can lose money in every interest rate environment, our analysis this month poses the question: How has the private credit market endeavored to make money in nearly every interest rate environment?

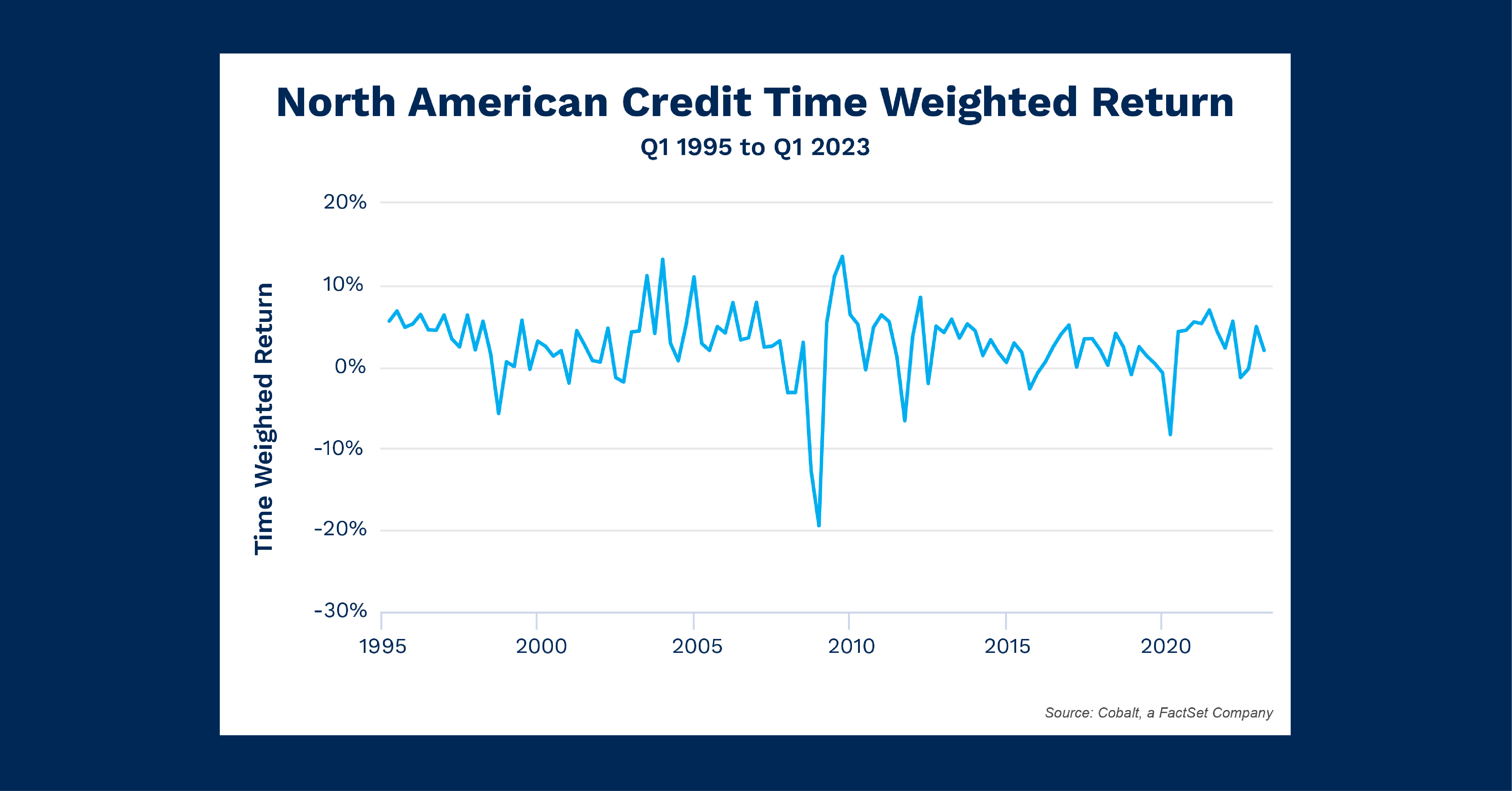

To investigate this, we pulled the private credit market return over the past few decades from Cobalt’s Market Data to see how these funds responded to changes in the federal rate, and to examine how they may have pivoted to remain profitable.

Key Takeaways

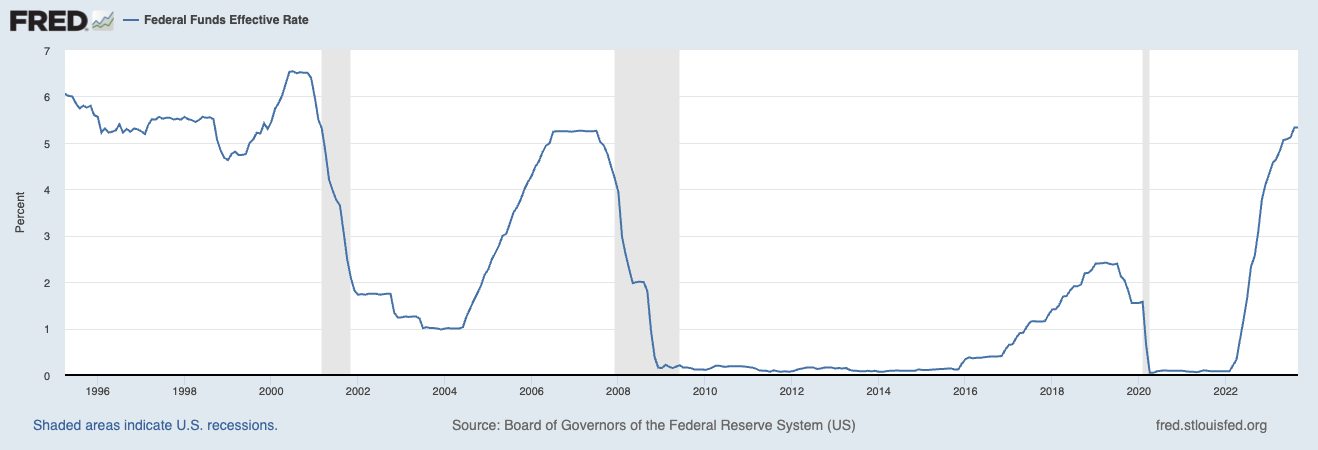

First, we can identify points of alignment between the two charts. The trough and peak in North American private credit returns between Q2 2008 and Q3 2009 clearly align with the 2008 recession and accompanying sharp drop in the Federal Funds Rate. We surmise that existing funds were gutted by portfolio company defaults, while new funds were used to acquire the distressed assets that became available.

Looking ahead, we see a smaller version of this event in 2020 that coincides with the COVID-19 pandemic drawdown. The lag times in both charts, however, are not consistent, indicating that the interest rate is not a strong predictor (or even a lagging indicator) of the private credit market performance.

By comparison, the private credit market is relatively agnostic to the Federal Funds Rate during the other periods. There appears to be no meaningful effect from the dot-com bubble and the subsequent rise in interest rates—or any strong effects from the rock-bottom rates of the “everything rally” of the 2010s.

However, on closer inspection, we can see a predictable increase in private credit volatility about three years after a recession, coupled with slight downward performance as the Funds Rate increases. The volatility was likely due to distressed purchases during downturns that began torealize their value or failure. The performance likely emerged from higher borrowing costs that cut into a private firm’s ability to increase financing to their portfolio.

Looking Ahead

Moving past the 2020 drawdown, we can apply our findings and predict a period of slightly higher credit volatility in the coming quarters. Additionally, as the Federal Reserve appears to be pausing its rapidly ascending rate hikes, we are left at a potential crossroads for the private markets.

On one hand, the pause could prolong economic health and sustain a high funds rate for longer, potentially eating into private credit returns. On the other hand, if a more recessionary event is close, then there may be ample cheap opportunities for distressed investors to buy.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…