Chart of the Month: February 2024

Buy the Rumor, Buy the News: Evaluating the Unshakable Interest in Real Estate

While investing in sanguine times has been an oft-held motto of contrarianism, what happens when even bad times are good times? Following up on last month’s analysis, we continue our analysis of the real estate market.

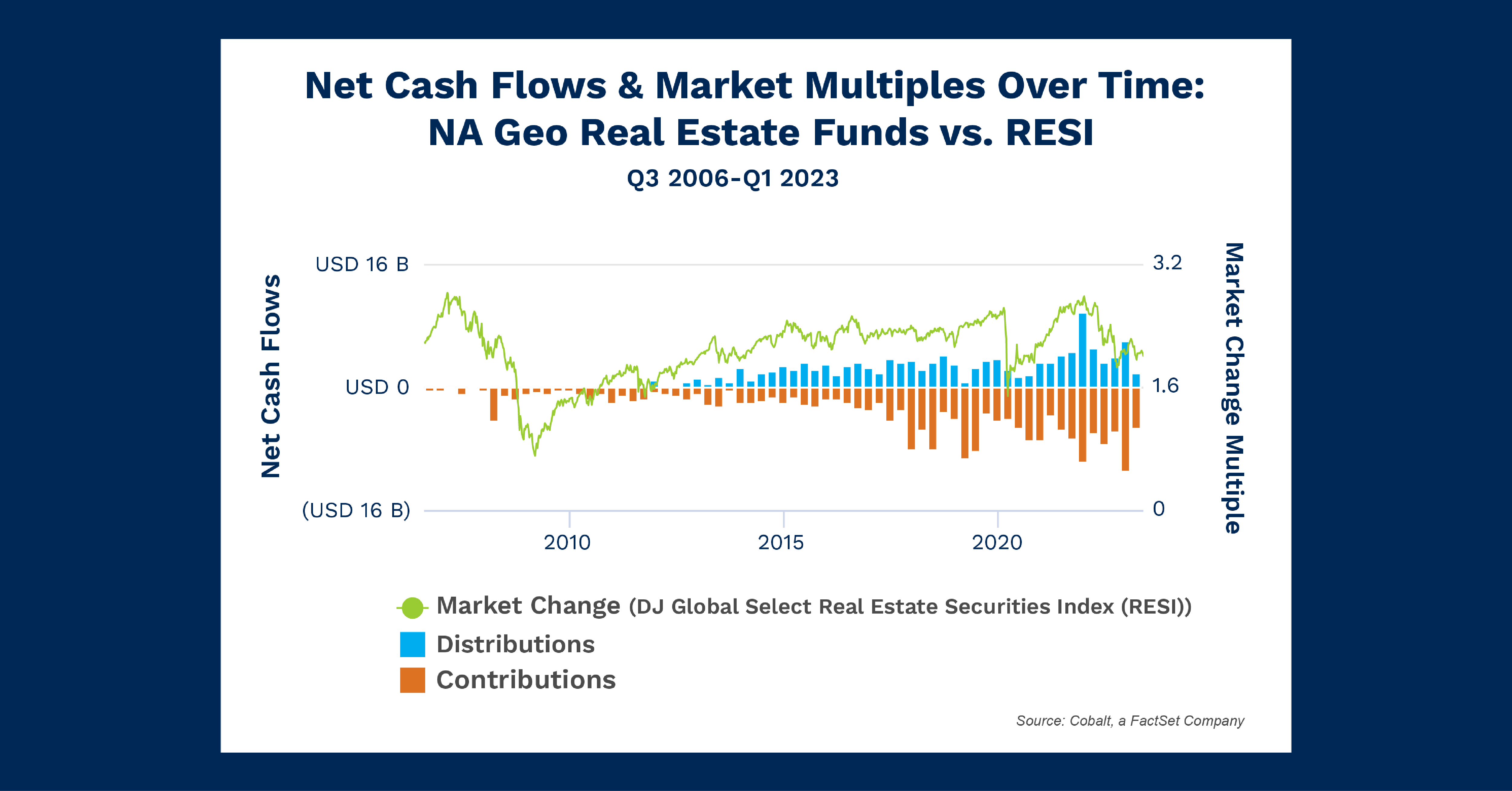

Long viewed as one of the safest markets, real estate has also seen dramatic increases in interest from both retail and commercial investors over the past decade. As such, we’re looking at real estate investor contribution and distribution values compared to the overall market change for a public real estate index, the DJ Global Select Real Estate Securities Index (RESI).

Key Takeaways

While our data on pre-2010 cash flows is sparser, readers who remember the events of 2008 might recoil at the idea of an invulnerable real estate market. As shown above, while the cash flows do not tell much, the index is very clear that real estate contributions were quite tepid coming out of the great financial crisis given shaken investor confidence.

This tepidity quickly waned, however, and the market was progressively built up with more investor interest and steady contributions through 2020.

Now in 2024, we see the same curiosity play out as it did in 2008, but for different reasons. The index dived in reaction to the pandemic, and the cash flows remained relatively fixed. This cannot be blamed on low data volume, but instead a perseverance of investor interest throughout the economic shock.

The confidence appears to have paid off, with distributions peaking in late 2021 alongside a peak in new contributions. This reaffirmed a desire to collect profits and reinvest the earnings in the real estate space—even amidst the real estate market lag of 2022 and 2023.

Looking Ahead

A second fallacy in the invulnerability argument is the bubble. One need only glance at a chart of US home prices to get a little concerned about the sustainability of this trend. The US is trying to ramp up new construction to stem the housing shortfall, and the open question of return to office looms over the commercial sector.

As we look forward into the rest of this decade, we expect some shakeups in real estate performance. It could be driven by either or both sector’s challenges and perceived overvaluation. However, whether the bubble bursts or local and national efforts to address supply and demand reign in the values, there will always be intrinsic value in the real estate sector.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…