Chart of the Month: December 2021

Across Two Ponds: Taking Another Look at Regional Real Estate from 2010-2021

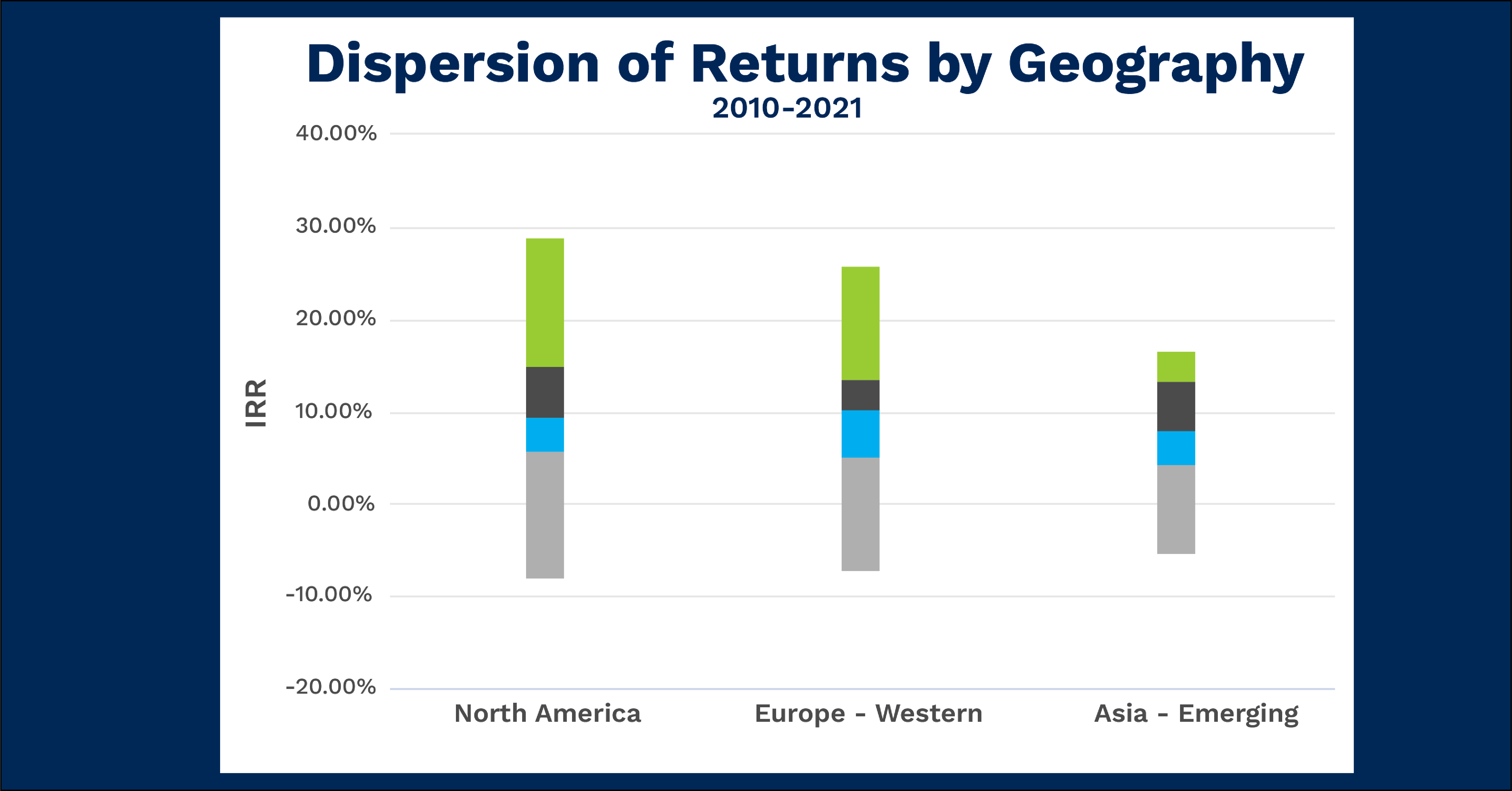

As the true extent of the cracks in China’s real estate market continue to unravel, we thought it would be prudent to examine the market again after October’s Chart of the Month, namely looking at the quartile breakdown of the three dominant real estate markets. We analyzed the dispersion of returns by geography from 2010-2021 to further illustrate how far each market strays from the internal rate of return (IRR) medians presented in the prior chart.

Key Takeaways:

- Unsurprisingly, we once again see the median IRR settle around 9-10% across all regions. However, we begin to see significant differences in the upper quartile, as the European and American funds demonstrate far higher upper fences in the upper quartile than their emerging Asia counterparts. Despite very high interest in emerging markets, this shows the sheer popularity of European and American real estate and thereby its ability to appreciate in value.

- On the loss side, North American and European investments do show closer lower fences in their lowest quartile. Surprisingly, emerging Asian markets also show a wider lower quartile for their overall volatility. This would indicate that compared to their relative stability in other levels of performance, when confidence erodes in low-performing investments, there is far lower fundamental value cushioning for these investments.

Looking Ahead:

- When we look at this chart compared to October’s, we see much the same data: all three markets display relatively similar average upsides with fairly low overall risk. We can now see that through another lens there are fair concerns about the health of emerging Asia real estate. In light of its recent shocks, can its lower historical upper quartiles and reasonably low lower quartiles provide the investor the interest needed to sustain their level of investments?

- Of course, the other markets have their share of risks as well with North American markets being accused of inflated value. A burst bubble could easily emerge amid rising interest rates and stabilizing work environments, reducing the retail demand for new home ownership.

- On either side of each ocean, we see a real estate market historically behaving as expected: profitably consistent. Only time will tell to see which market buckles the worst under the looming specter of cooling demand, if it ever truly arrives.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…