Cobalt Chart of the Month: August 2020

Cobalt Market Data Chart of the Month

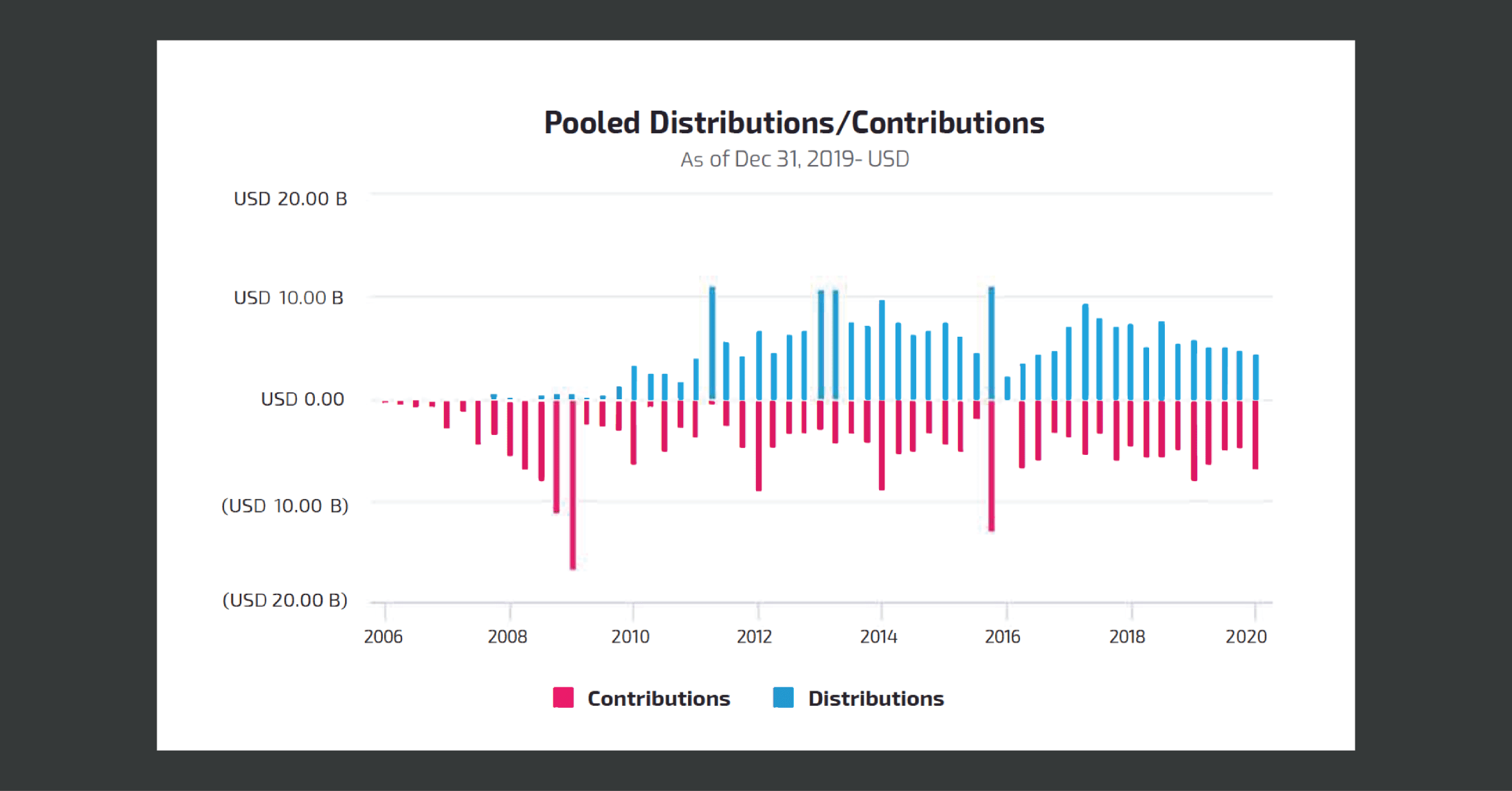

Pooled Distributions/Contributions of Distressed Credit Funds from 2005 to 2019

This chart emphasizes the popularity of distressed credit funds during the 2008 recession, and how this run-up was followed by an immediate correction in Q1 of 2009. After the correction, contributions were relatively stable for the following decade, but did exhibit periods of volatility such as that seen in late 2015.

Key Takeaways:

- The total commitments to distressed credit funds in 2020 will likely mirror the sharp increase as seen from 2007 to the end of 2008. This is likely because many investors see the current economic situation as a major investment opportunity; they can either help resolve existing debts for companies that continue to operate as usual, or they are willing to take the risk that coronavirus will be over before many distressed companies go completely under.

- Profitable and innovative companies that were thriving before COVID-19 are already burning cash from an inability to conduct virtual business, creating a wide variety of distressed opportunities. If companies continue to bleed cash and incorporate more debt without adjusting to virtual business, investors will be forced to back out or reinforce their positions to prevent bankruptcy.

- Investing in distressed credit today has new risks compared to 2008. The recovery period could potentially be longer depending on the duration of the coronavirus, and the current economic situation will continue to disrupt business for an uncertain amount of time until there is a vaccine or treatment.

Looking Ahead:

- Will the uncertainty of COVID-19 and the unease involved with reopening business shape the performance of these distressed credit funds?

- Will the saturation of distressed credit funds impact the rate of bankruptcy in the coming year?

- Will we see an immediate run on these funds or will it take a few quarters to make the shift?

- Will follow-on and double-down funds exercise caution or aggressively back potential gems within their portfolio?

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…