Cobalt Chart of the Month: February 2021

Cobalt Market Data / Chart of the Month

After looking at the performance of follow-on investments back in October, we wanted to examine how some of those follow-on funds have behaved since the last recession to gauge how they may respond to the tumult of 2020.

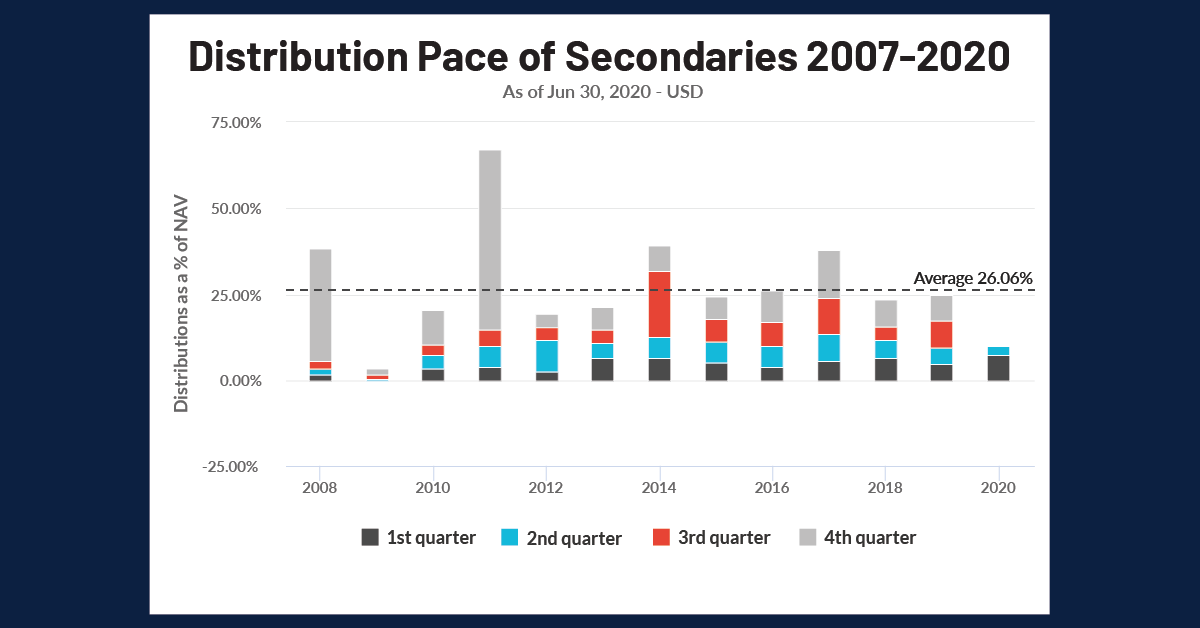

In our examination below we looked at all secondary funds since 2007 and broke it down by percent of the NAV that was paid out each quarter.

Cyclicality in the Secondaries Distributions

Key Takeaways:

- More than most styles, secondaries follow a cyclical pattern of distributions. Starting in 2008, distribution pace peaked and then hit a trough the next year before building to another peak within two years. This cycle has been the dominant trend since the financial crisis, which could be due to a large number of successful funds in 2007-2008 leading to above average distributions 3-4 years later, coinciding with the next fundraise of those fund families, creating some vintage concentration.

- In the past two years, we have seen a cessation of this trend as the pace has been constant since the 2017 peak and the overall oscillation has been dampening. This is likely due to both the lack of distributions for funds in the last three years (as they have not necessarily matured), as well as the fund concentration and abnormal performance factors diminishing over time as new funds enter the market.

Looking Ahead

- As 2020 has created drastic shifts in demand and revenue, historical funds will see much higher volatility in their NAVs. For those firms gaining business during the pandemic. this could cause a spike in distribution pace. For those hit hard, value conservation could produce a sharp drop in distributions. Despite the uncertainty these demand forces have brought, the distribution rate for 2020 is roughly on pace with the past 2 years through June 30th.

- Since this cyclical regime of the 2010’s coincided with a recession, it could be that the depressed prices seen in last year will create a similar profitable fund concentration and thus another distribution spike in 2023-2024.

Subscribe to our blog:

Chart of the Month: April 2024

Surge Pricing: Examining the Ability to Adjust North America Infrastructure Investing on a Short Timeline The state of Infrastructure investing…

Chart of the Month: March 2024

Law of Averages: Comparing 3 Decades of Commitments Among Buyout, Venture Capital, and Credit Funds In private markets, we regularly…

Cobalt Expands Data Regions: A Step Forward in Addressing Data Residency Concerns while Ensuring Security, Privacy, and Control

Cobalt Expands Data Regions: A Step Forward in Addressing Data Residency Concerns while Ensuring Security, Privacy, and Control At Cobalt,…